ECB Forum on Central Banking 2023 Recap

- Powell reiterates the need to slow the pace and magnitude of tightening a peak rates appear near

- ECB’s Lagarde brushes off any notion of a pause, sees hike in July as likely outcome

- BoE’s Bailey sees inflation dropping despite a more resilient economy and labour market

- BoJ's Ueda states that confidence of continued inflation will test easy monetary policy

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Powell Reiterates the need to slow the tightening pace and magnitude as Peak Rates Nears

The Chairman of the Federal Reserve Bank Jerome Powell took part in a panel discussion alongside heads of the BoE, ECB and BoJ where new information proved hard to come by despite the best efforts of the interviewer.

Powell detailed the thinking behind the last FOMC meeting where the large number of Fed officials were in favour of seeing the median Fed funds rate at 5.6% despite the apparent slowdown in the pace of hikes. At one stage the Fed instituted four 75 bps hikes in a row before slowing the cadence down to 50, then 25. The decision to skip a hike in June does not necessarily imply a hike at every other meeting as Powell stated he cannot rule out rate hikes at consecutive meetings from here on.

The tight labour market continues to push rates further restrictive and Powell noted that softening in the labour market has been witnessed but was slower than expected. Ultimately, Powell expressed that policy is restrictive but there will be more tightening until policy is viewed as sufficiently restrictive to bring inflation down to the 2% target.

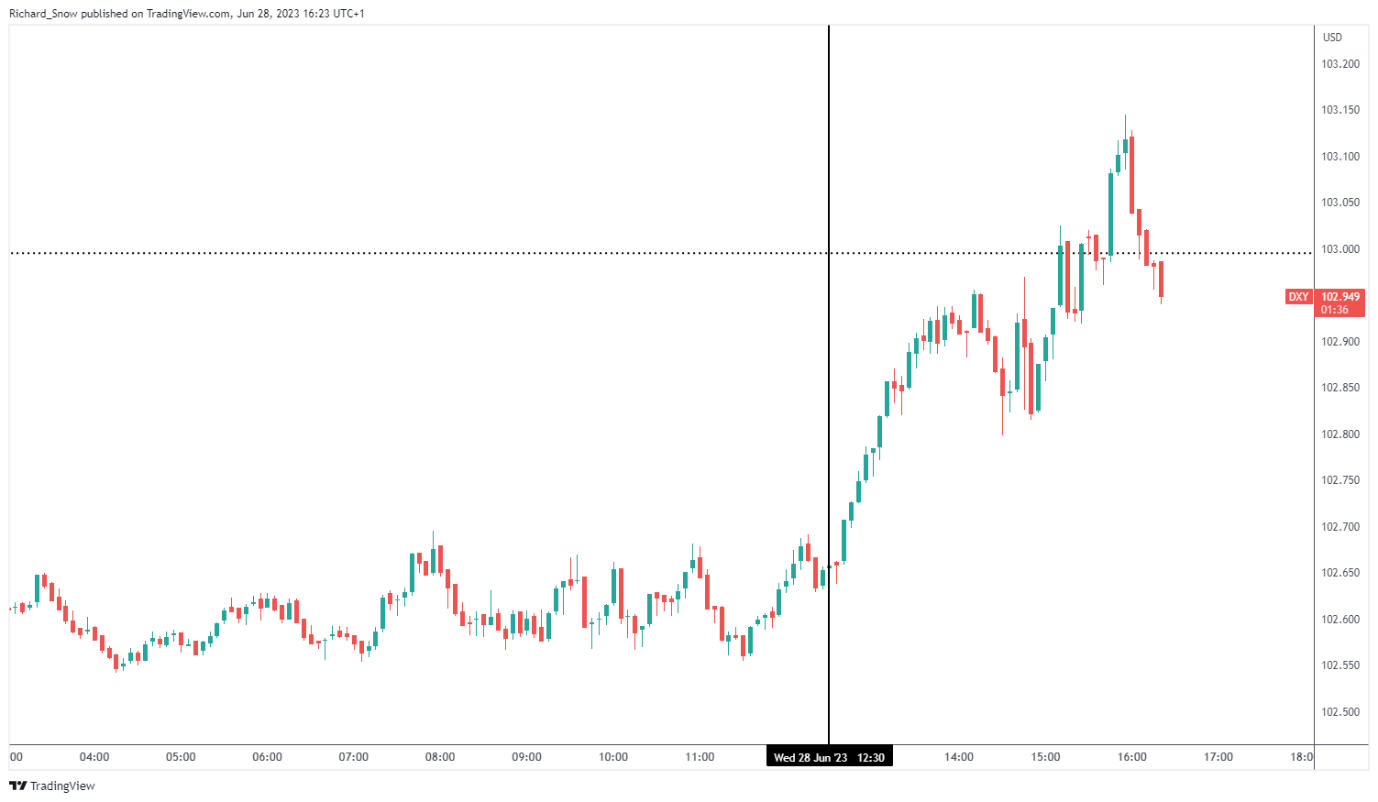

The dollar (US Dollar basket) rose during the remarks alongside the S&P 500, however markets appear to be fading a sizeable portion of those early gains in the aftermath of the discussion. Keep a look out for US bank stress test updates (21:30 UK time) and how this could impact US assets and particularly banking sector indices.

US dollar basket 5-min chart

Source: TradingView, prepared by Richard Snow

ECB’s Lagarde Brushes off Any Notion of a Pause, Sees Hike in July as Likely Outcome

ECB President Christine Lagarde admits there is still ground to cover and sees another hike in July should baseline projections hold. Lagarde also referred to the unimpressive economic data in Europe at the moment but brushed off suggestions of a recession. Instead, the ECB President referred to growth in Q1 being flat but admitting that economic growth is stagnant. In support of that assessment, she pointed to uninspiring Q2 data for the manufacturing sector.

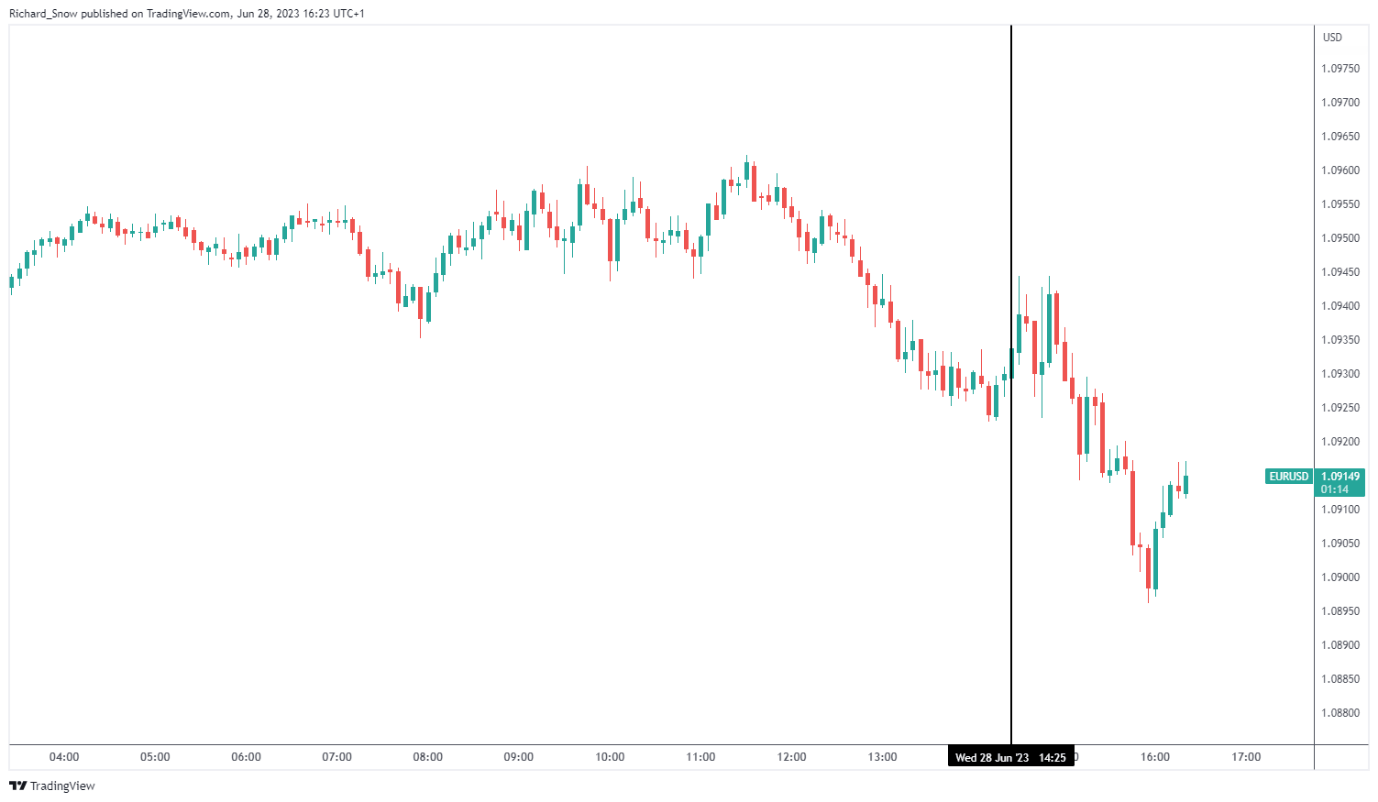

EUR/USD fell during the panel discussion but the common observation of a partial retracement of the initial move holds for EUR/USD too.

EUR/USD 5-min chart

Source: TradingView, prepared by Richard Snow

Bank of England Governor Bailey Sees Inflation Dropping Despite a More Resilient Economy

Bank of England Governor Andrew Bailey expanded on the reason why the committee decided to go with a surprising 50 bps hike as inflation showed persistence in the latest core and headline measures of inflation. The UK is finding inflation much harder to bring under control than the EU and the US, something that Bailey said was due to labour market dynamics. The UK labour force is yet to recover to pre-pandemic levels as labor supply shortages continue to support wage increases as companies are more and more reluctant to let go of staff.

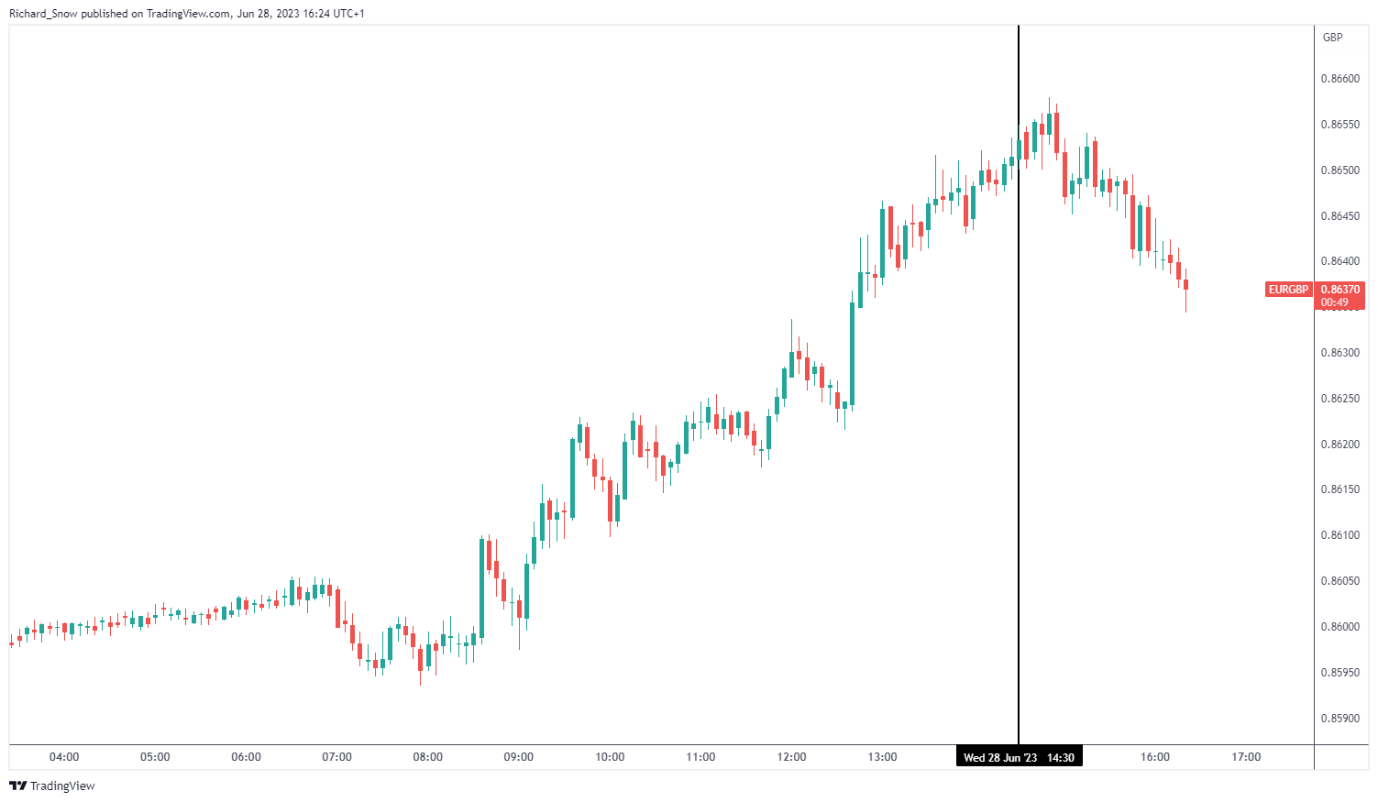

The pound weakened ahead of the panel discussion and actually gained some lost ground in the moments that followed.

EUR/GBP 5-min chart

Source: TradingView, prepared by Richard Snow

BoJ Governor Ueda stood out as the Bank of Japan has been synonymous with ultra-easy monetary policy - in contrast with the other panelists although he did specify that if the Bank is confident that medium term inflation forecasts see price pressures rising, that this would be possible grounds for policy change.

Next up this week we have German and EU inflation data for June, final US and UK Q1 GDP figures, Chinese Manufacturing data and core PCE.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX