Australian Dollar Forecast: Neutral

- The Australian Dollar found firmer footing on US Dollar debility

- The Fed look likely to raise by less than 75 bp while the RBNZ are adopting it

- The RBNZ might know something that the RBA doesn’t. Will it sink AUD/NZD?

The Australian Dollar surged toward a 2-month high at the end last week as the US Dollar collapsed on the market perception of a change in Federal Reserve policy.

Federal Open Market Committee (FOMC) meeting minutes revealed what astute observers already knew. That is, ongoing rate hikes appear likely to be less than the four 75 basis point (bp) jumbo lifts seen previously.

The short-term interest rate market continues to price in a 50 bp bump up at the December Fed gathering. This hasn’t changed from prior to the last meeting.

Nonetheless, the market interpreted the minutes as a dovish tilt and the US Dollar followed long-end Treasury yields lower.

Across the ditch, the Reserve Bank of New Zealand (RBNZ) re-accelerated their rate hiking program, adding 75 bp to their official cash rate (OCR) last Tuesday, which is now 4.25%. They had been consistently lifting by 50 bp previously.

Their action followed a surge in inflation, with the latest print coming in at 7.2% year-on-year to the end of the third quarter. The bank has an inflation target band of 1-3%.

In contrast, the Reserve Bank of Australia have pared back their hawkishness. They raised the cash rate by only 25 bp at the October and November monetary policy meetings to get to 2.85% currently.

This is instead of 50 bp that they had been doing in June, July, August and September. The latest inflation data showed an acceleration to the end of the third quarter. The RBA is now dealing with 7.3% year-on-year price pressures. The bank has an inflation target band of 2-3%.

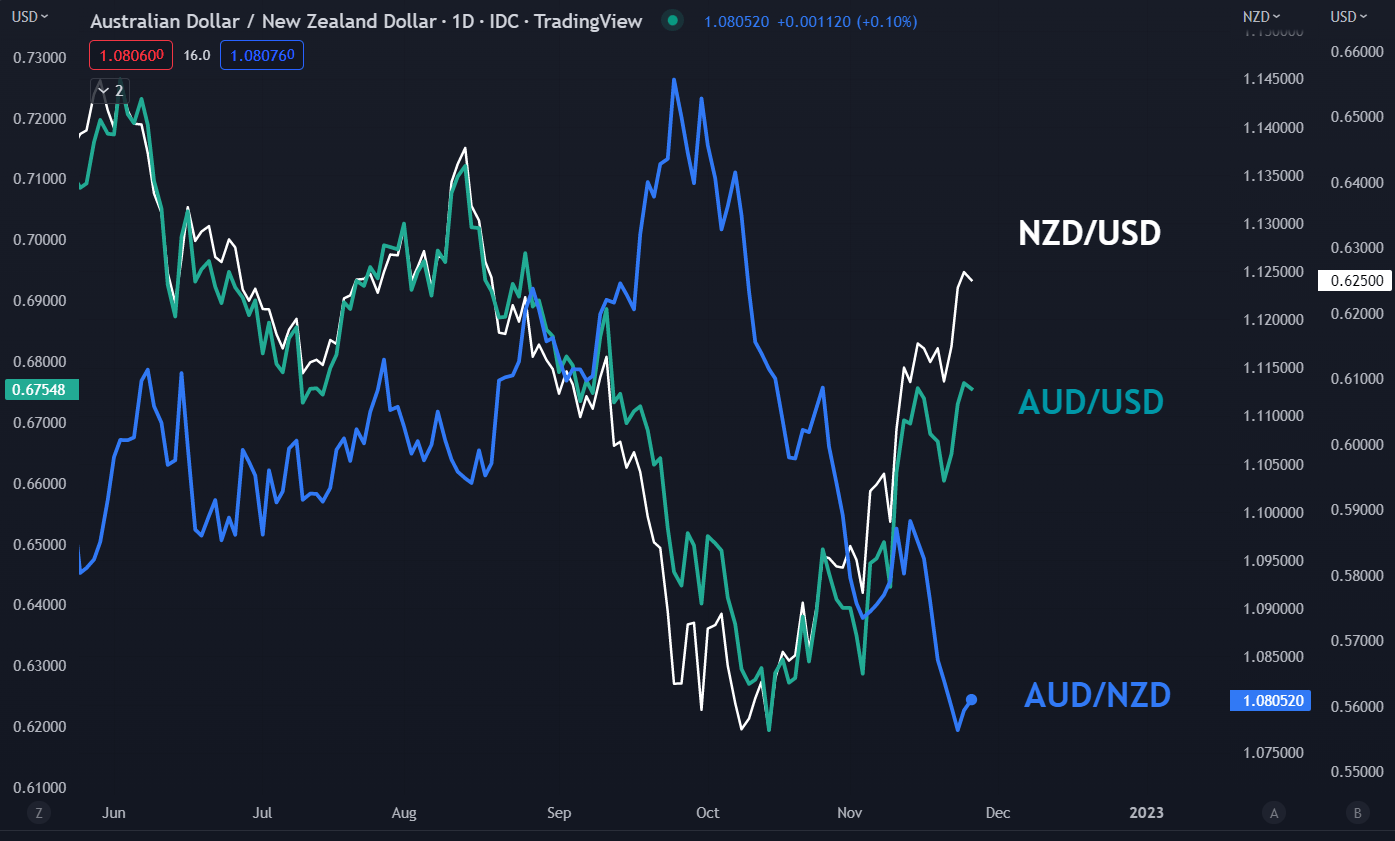

The relative dovishness from the RBA compared to the RBNZ has seen AUD/NZD slide to an 8-month low.

The RBA appear to be comfortable that they have inflation under control. The Fed had similar thoughts through to the end of 2021 and are staring at a “Volcker-style solution” where the economy has to be slowed significantly in order to contain inflation.

In the week ahead, the Australian Bureau of Statistics (ABS) will release their first monthly CPI number. There will be two such release between the quarterly figures. This print will cover 62-73% of the weighted quarterly basket. More details can be read here.

AUD/USD – AUD/NZD – NZD/USD

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter