AUD/USD, Australian Dollar, RBA, GDP – Talking Points:

- The Australian economy slowed in Q2, but less than expected.

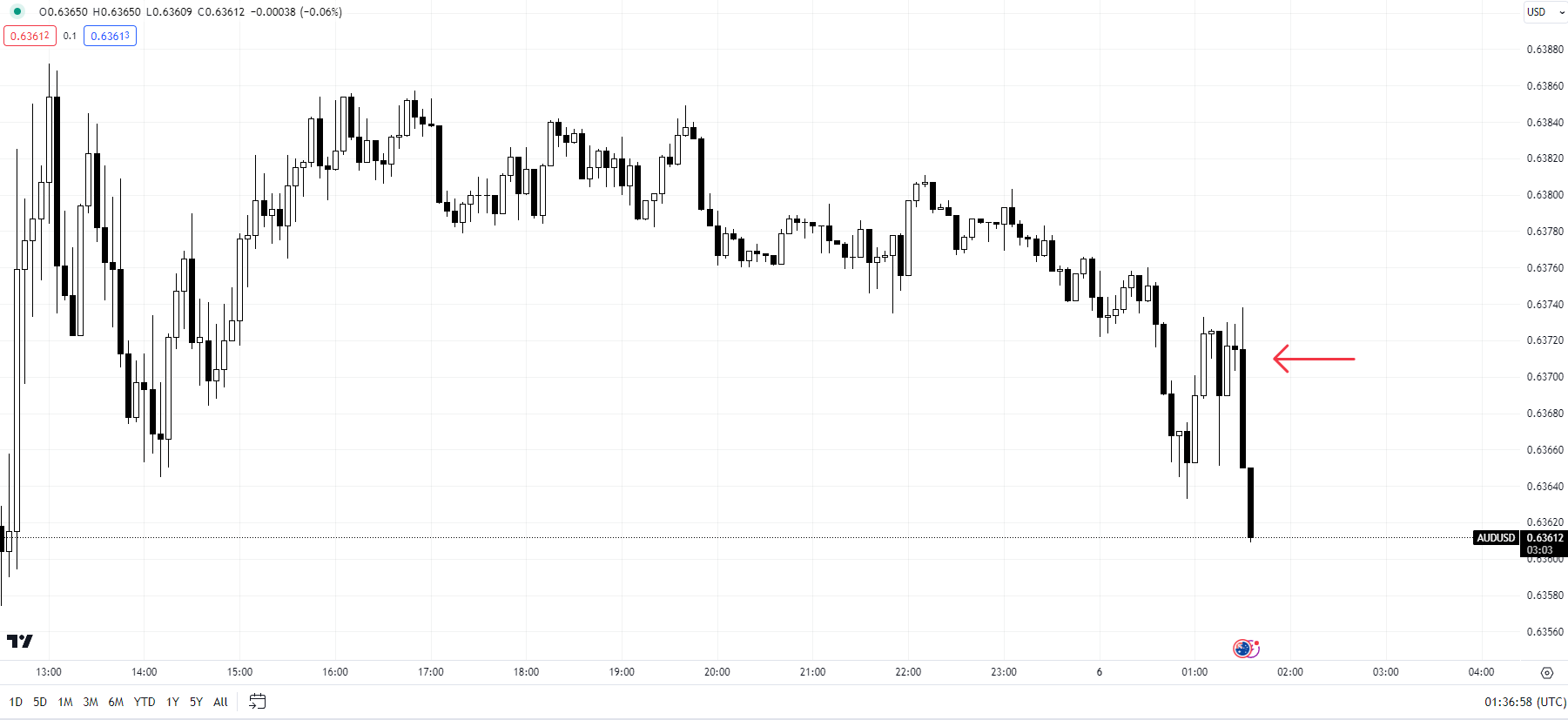

- AUD/USD declined after the data release and is now testing key support.

- What’s next for AUD/USD?

The Australian dollar fell against the US dollar after the Australian economy slowed in the second quarter of the year, reinforcing the growing view that the Reserve Bank of Australia (RBA) is done with hiking interest rates.

The economy grew 2.1% on-year in the April-June quarter from 2.3% in the January-March quarter, compared with 1.8% expected, and 2.7% in the last quarter of 2022. GDP grew 0.4% on-quarter, in line with expectations, after net export volumes expanded more than twice analysts’ expectations as the government spent big on infrastructure during the quarter, offsetting the softness in household consumption.

AUD/USD 5-minute Chart

Chart Created Using TradingView

The data trajectory is likely to further strengthen the belief that the RBA will keep interest rates on hold for the rest of the year. At its meeting on Tuesday, the RBA kept interest rates on hold, saying recent data were consistent with inflation returning to the 2-3% target range by 2025, boosting hopes that the tightening cycle was over.

However, the central bank reiterated that further tightening may still be required, though it would depend on the outlook for inflation and the labour market. Australia's CPI eased more than expected in July, coinciding with the RBA’s view that the worst is probably over for inflation. Markets see a small probability of one last hike before the end of 2023.

Much would depend on the outlook with regard to the Chinese economy, as the RBA noted on Tuesday while keeping the cash rate steady at 4.1%. Chinese policymakers have responded with a spate of support/stimulus measures in recent months, but those measures have yet to have a meaningful impact on sentiment. China is Australia’s largest export destination.

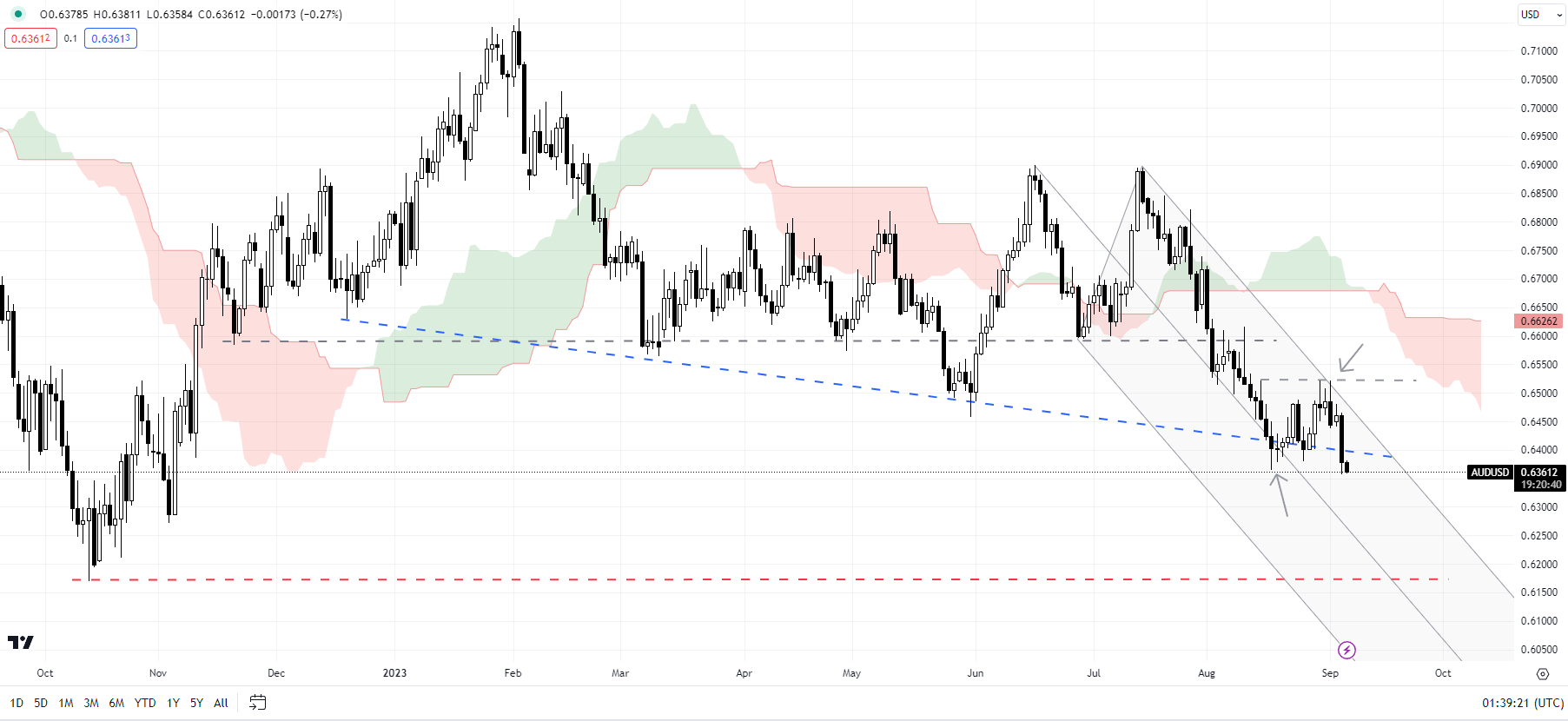

AUD/USD Daily Chart

Chart Created Using TradingView

On technical charts, after a brief reprieve, AUD/USD is retesting the multi-month low of 0.6360 hit in August. Any decisive break below could initially pave the way toward the early November 2022 low of 0.6270, with major support at the October 2022 low of 0.6170. On the upside, the pair would need to rise above immediate resistance at last week’s high of 0.6525 for the imminent downward pressure to fade.

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish