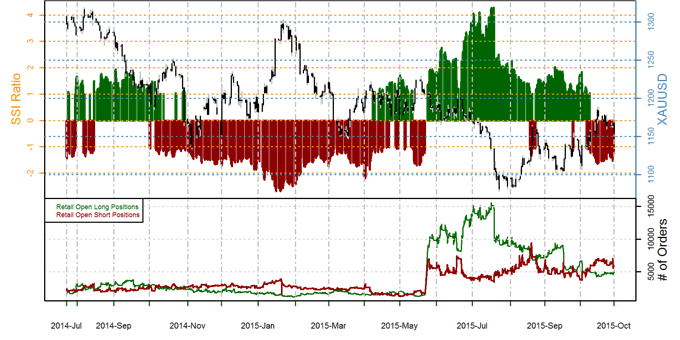

Why and how do we use the SSI in trading? View our video and download the free indicator here

Gold– A sharp drop in gold prices has led to a similarly pronounced shift in retail forex trader positioning, and our data suggests that the broader trend may have turned in favor of XAU/USD declines. Last week we noted that a notable majority of traders in our sample remained short Gold prices versus the US Dollar, but a clear wave of profit-taking leaves net-positioning almost exactly flat at time of writing.

We see little choice but to withdraw our calls for further XAU gains. Yet we would ideally see a sharp jump in retail FX trader buying before turning in favor of selling into any Gold price declines.

See next currency section: EURUSD - Euro Forecast to Fall even Further until this Changes

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX