Why and how do we use the SSI in trading? View our video and download the free indicator here

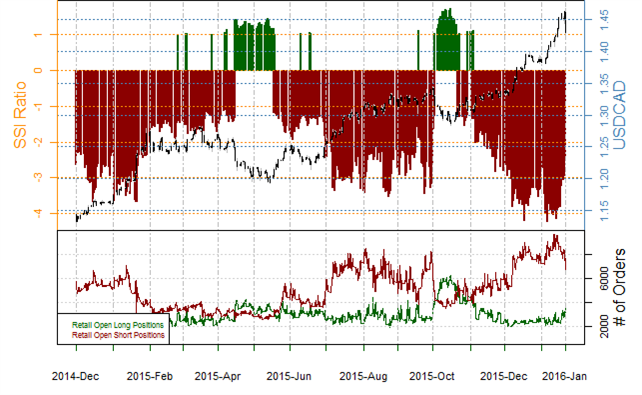

USDCAD– Retail FX traders remain extremely short the US Dollar versus the Canadian Dollar, and we will most often take this as contrarian signal that the USD/CAD may continue higher. Yet a notable shift since last week warns that we could see the trend slow or even reverse through near-term trading.

Our data shows that there remain two open short positions for every one long—a heavily one-sided skew. It was nonetheless just a week ago when the data showed nearly four short positions per long; open long positions surged 45 percent while short positions dropped 24 percent.

This substantial shift occurs just weeks after aggregate positioning hit its most net-short since at least 2011. And indeed, a sharp turn from such one-sided extremes acts as early warning of a potentially significant turn in trend.

See next currency section: AUDUSD - Australian Dollar Likely to Continue Lower

Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX