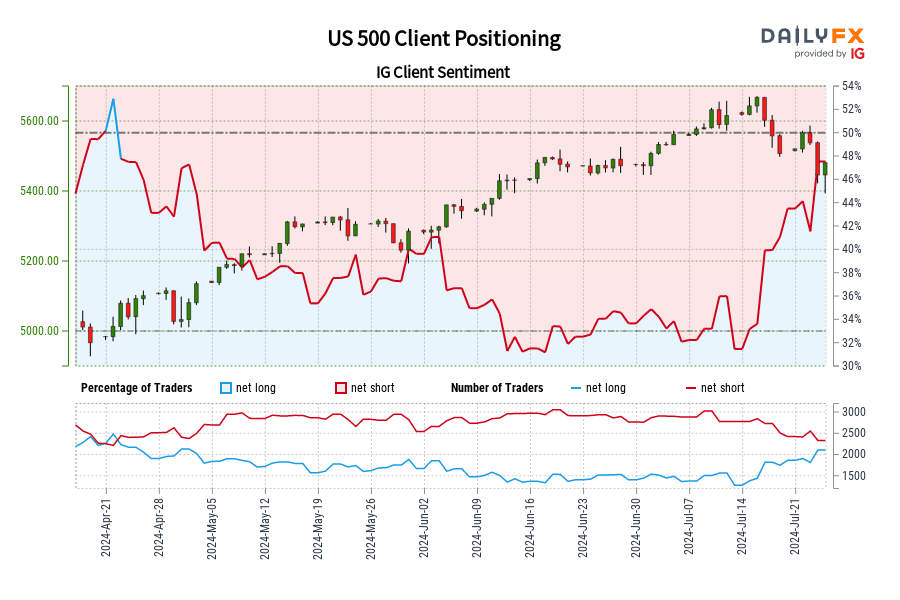

- Retail FX traders remain heavily long US Dollar versus Yen and Euro ahead of Fed decision

- Next moves in USD pairs and sentiment likely to prove pivotal. Here’s what we’re watching

- Why do we use retail sentiment as a contrarian indicator? View our video guide

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

EURUSD - Euro Risks to Topside, but FOMC Decision Remains Critical

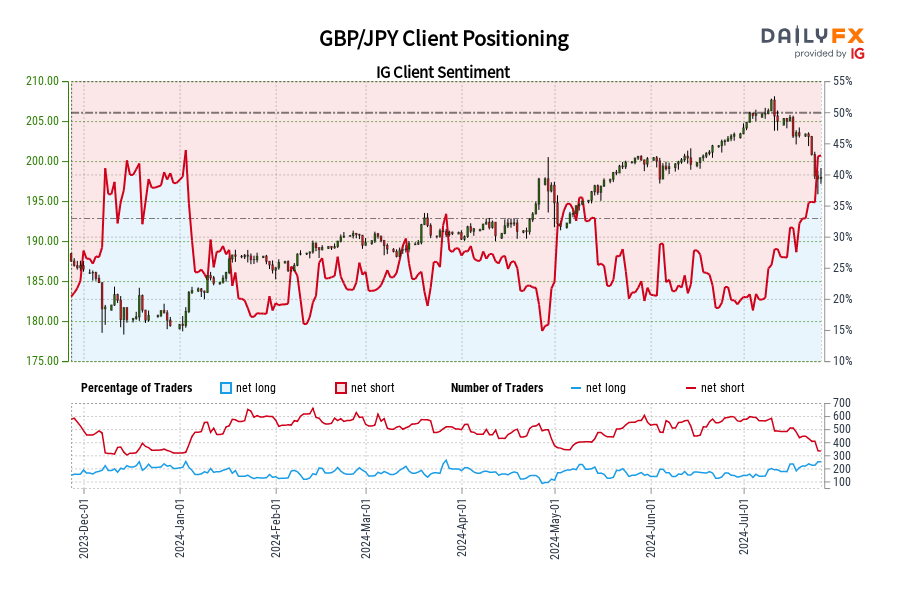

GBPUSD - British Pound May Drop, but We’re Waiting for Bigger Shift in Sentiment

USDJPY - We’ll Wait to See Major US Dollar Breakout versus the Yen

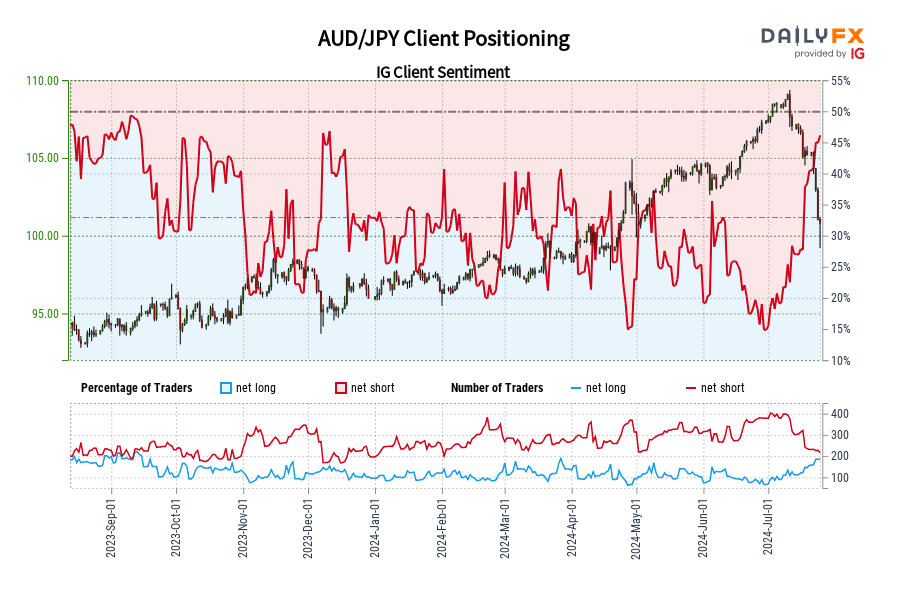

AUDUSD - Australian Dollar Downtrend Intact, but for How Long?

NZDUSD - New Zealand Dollar Forecast Remains Cautiously Bearish

XAUUSD - Gold Prices Show Signs of Life

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

The US Dollar is at a potential turning point ahead of the US Federal Reserve interest rate decision. Here is what our retail FX trader data is telling us.

View Real-Time SSI Updates via the FXCM Trading Station Desktop

See a video on how we use the Speculative Sentiment Index in our trading

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX