Talking Points:

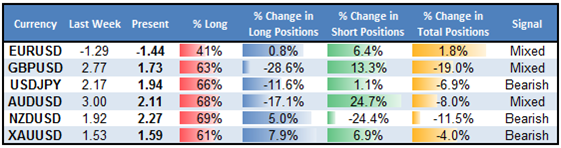

- Retail crowd reduces net-long USD position against AUD, EUR, GBP.

- USDJPY positioning still favors further downside in the pair.

- Gold will struggle to rally as crowd remains net-long.

View individual currency sections:

EURUSD – Minor Shift in Crowd Positioning Leaves Euro Outlook Mixed

GBPUSD - British Pound Forecast Neutralized after Big Shift in Positioning

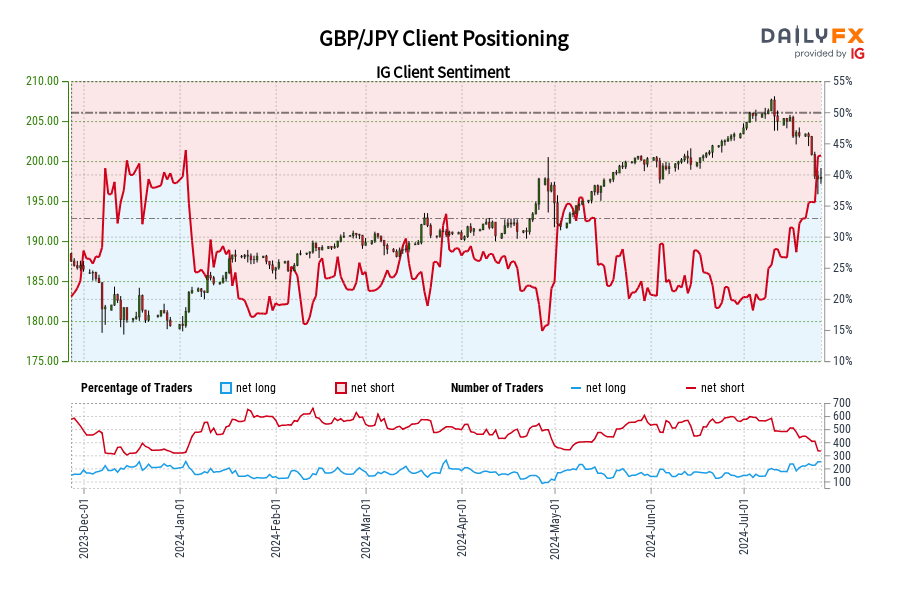

USDJPY – Japanese Yen Remains Favorable versus US Dollar

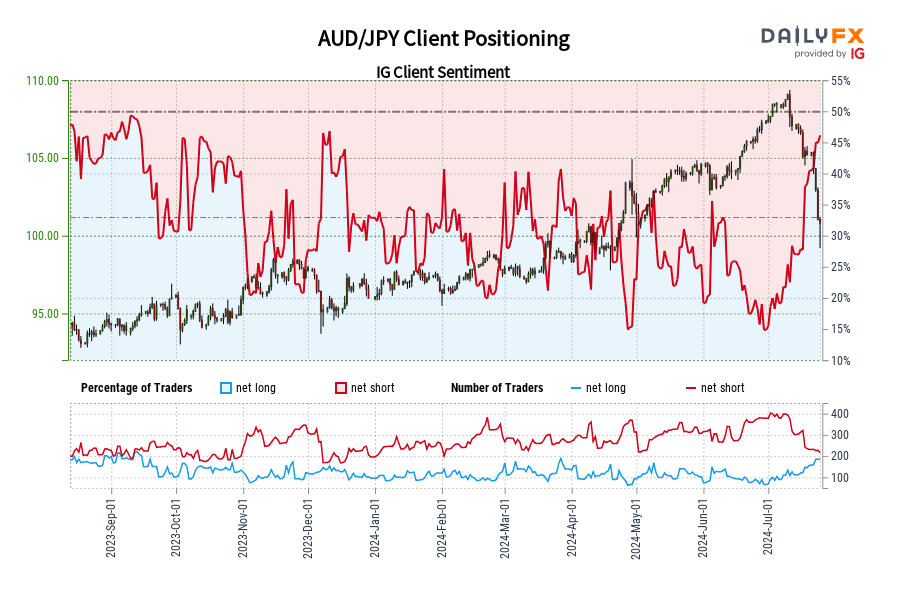

AUDUSD - Australian Dollar Decline May Be Nearing Short-term Turn

NZDUSD - New Zealand Dollar Losses Forecast to Continue

XAUUSD - Gold Lacks Luster as Positioning Calls for More Losses

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

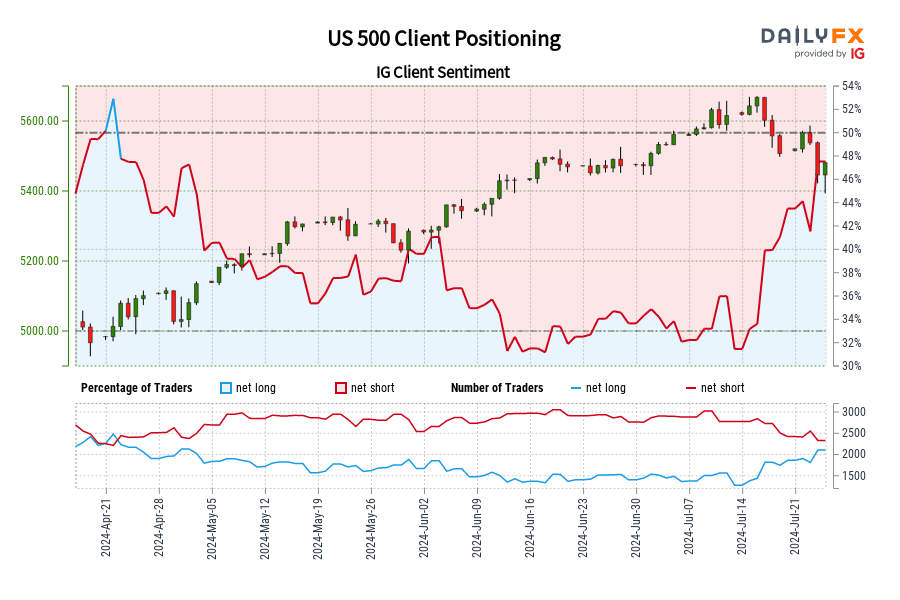

The week before the Federal Reserve meets for its highly anticipated September policy meeting, the retail crowd is already scaling back long US Dollar exposure. Accordingly, our AUDUSD, EURUSD, and GBPUSD forecasts have been neutralized ahead of what should be a tense week in the run up to the September 17 meeting.

View Real-Time SSI Updates via the FXCM Trading Station Desktop

See a video on how we use the Speculative Sentiment Index in our trading

How do we interpret the SSI? Watch an FXCM Expo Presentation that explains the SSI.

--- Written by Christopher Vecchio, Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form