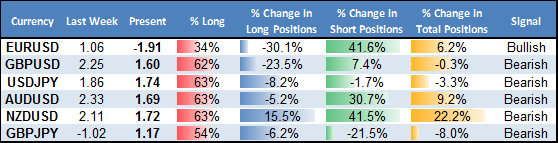

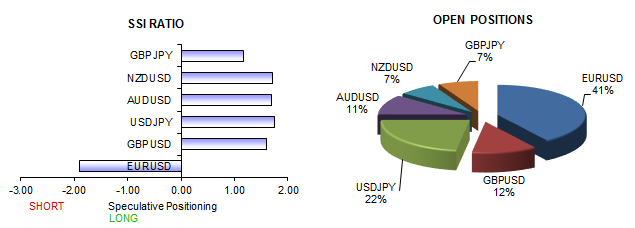

- Euro may have turned the corner versus US Dollar on sentiment shift

- Greenback remains in control versus Australian Dollar, Kiwi Dollar

- See full analysis below in individual currency sections

Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

View individual currency sections:

EURUSD - Euro Likely Turns Corner as Crowds Sell Aggressively

GBPUSD - British Pound Remains in Clear Downtrend

USDJPY - Japanese Yen Sticks to Consolidation Pattern

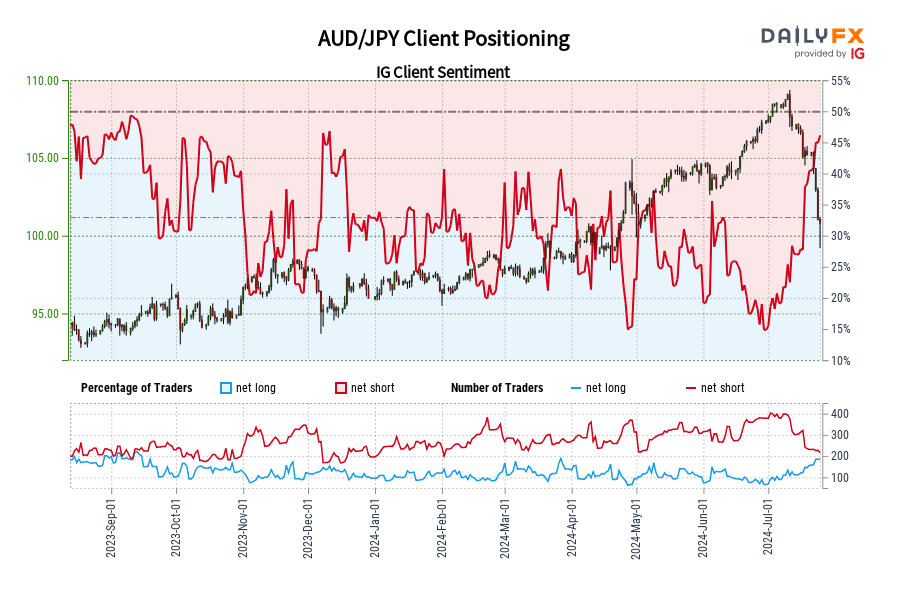

AUDUSD - Australian Dollar Poised for Further Losses

NZDUSD - New Zealand Dollar Forecast to Fall Further

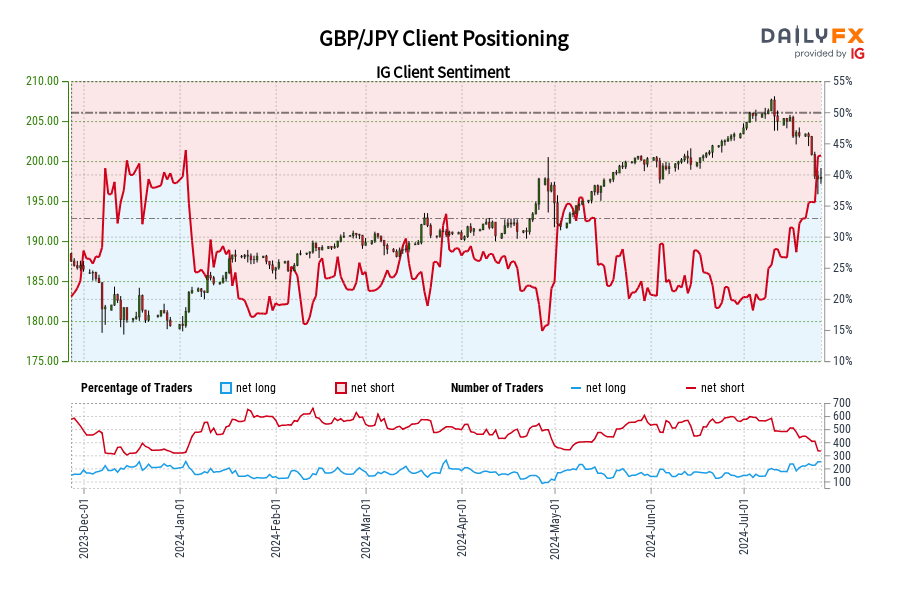

GBPJPY - British Pound Outlook Turns Bearish versus Japanese Yen

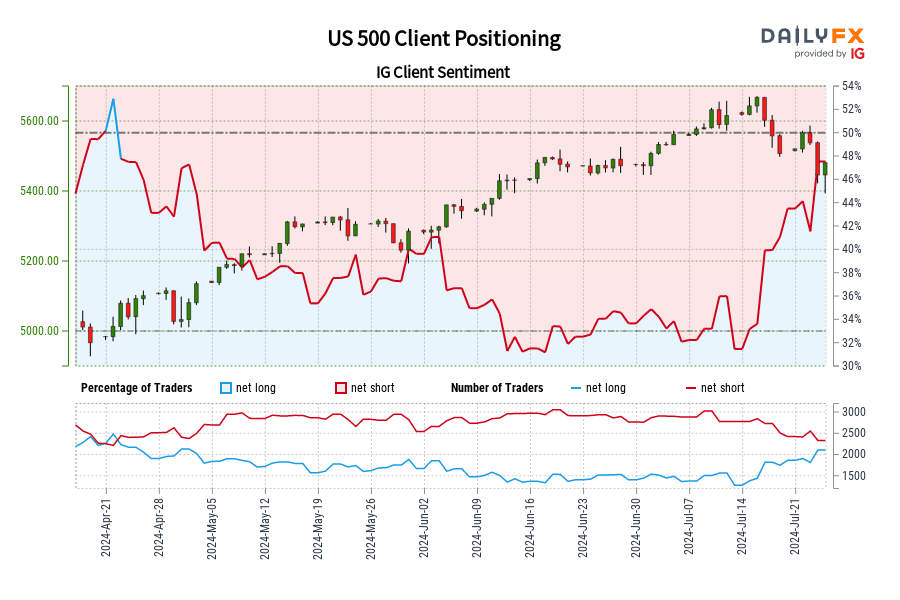

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

An important shift in retail FX positioning suggests that the Euro may have turned the corner versus the US Dollar. Here’s what we’re watching.

See specific US Dollar forecasts in the sections above, and sign up for future e-mail updates via this author’s e-mail distribution list.

Automate our SSI-based trading strategies via Mirror Trader free of charge

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX