Why and how do we use the SSI in trading? View our video and download the free indicator here

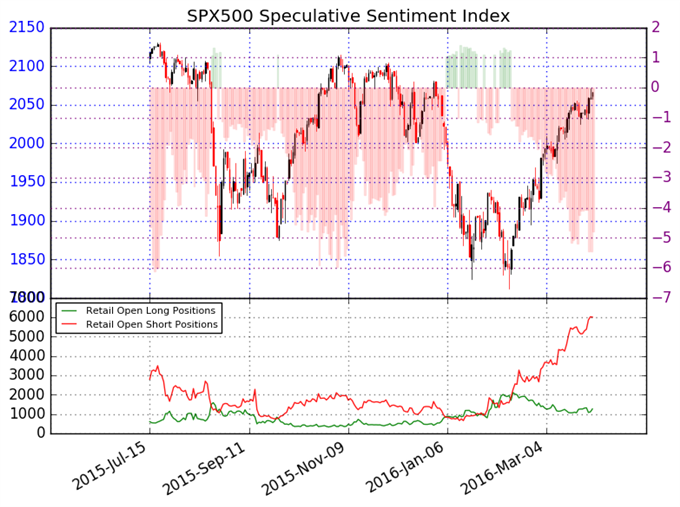

US S&P 500– Retail CFD traders have never been so short the SPX500, and a contrarian view of crowd sentiment points to further S&P gains. The clear caveat and difficulty is that such heavily-sided sentiment often coincides with major price extremes—traders are often most short at major tops. These extremes are nonetheless only visible in hindsight, and we would need to see a substantial sentiment shift in the opposite direction to call for a meaningful pullback.

It was only last week we claimed such a move had occurred, but clearly we were caught on the wrong side of a major rebound higher. We will continue to watch for further S&P gains until we see a more lasting shift.

See next currency section: EURUSD - Euro Puts our Trading Strategy to a Real Test

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX