Why and how do we use the SSI in trading? View our video and download the free indicator here

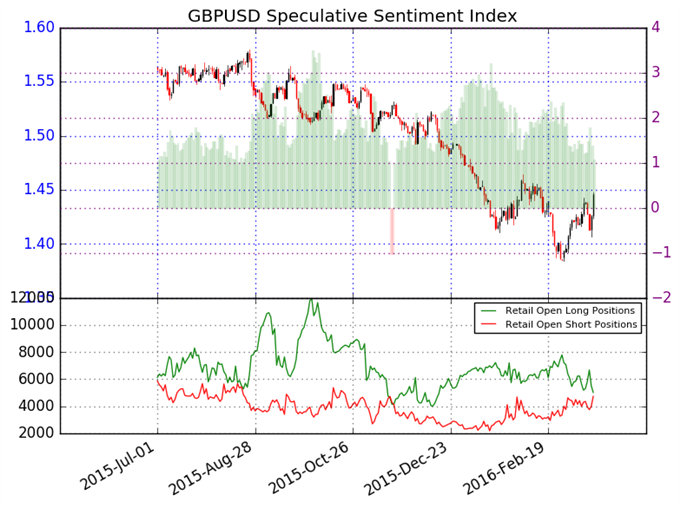

GBPUSD– An aggressive shift in retail FX trader sentiment warns that the British Pound may be at the cusp of a major reversal higher. Our data shows the majority of traders have remained long the GBP/USD since it traded above $1.50 through November of last year. Yet many of the same retail speculators are quite nearly net-short the GBP; this marks a substantive shift in sentiment.

It is of course possible that our Speculative Sentiment Index will not flip direction and the GBP/USD will instead continue in its much broader downtrend. The larger US Dollar sell-off nonetheless suggests that traders should watch for near-term GBP/USD gains.

See next currency section: AUDUSD - Australian Dollar Forecast to Gain Further

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX