Receive the Weekly Speculative Sentiment Index report via PDF via David’s e-mail distribution list.

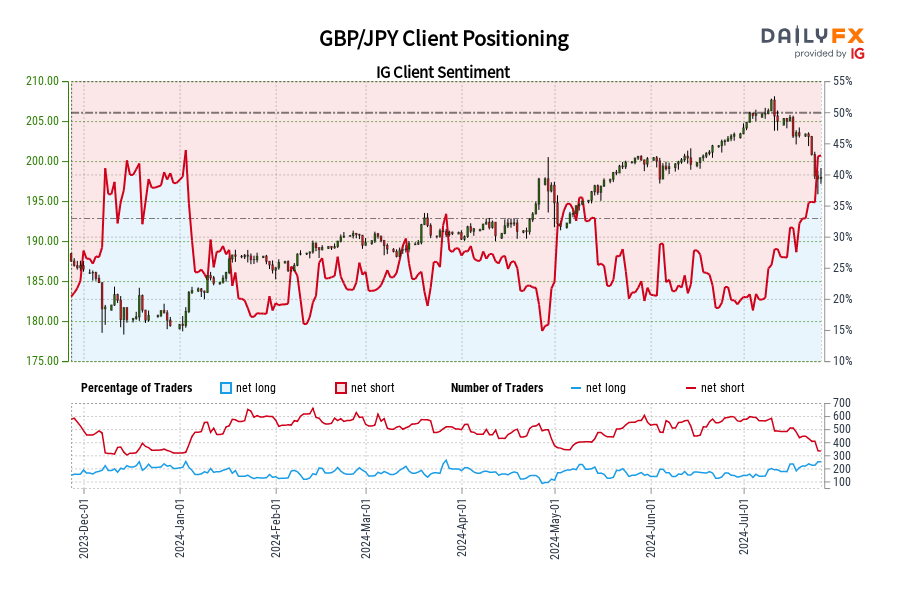

GBPJPY - The ratio of long to short positions in the GBPJPY stands at 1.61 as 62% of traders are long. Yesterday the ratio was 1.77; 64% of open positions were long. Long positions are 11.5% lower than yesterday and 12.7% above levels seen last week. Short positions are 2.9% lower than yesterday and 4.2% below levels seen last week. Open interest is 8.4% lower than yesterday and 2.2% below its monthly average. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the GBPJPY may continue lower. The trading crowd has grown less net-long from yesterday but further long since last week. The combination of current sentiment and recent changes gives a further mixed trading bias.

See next currency section: EURUSD - Retail FX Traders Remain Short Euro versus US Dollar

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX