Why and how do we use the SSI in trading? View our video and download the free indicator here

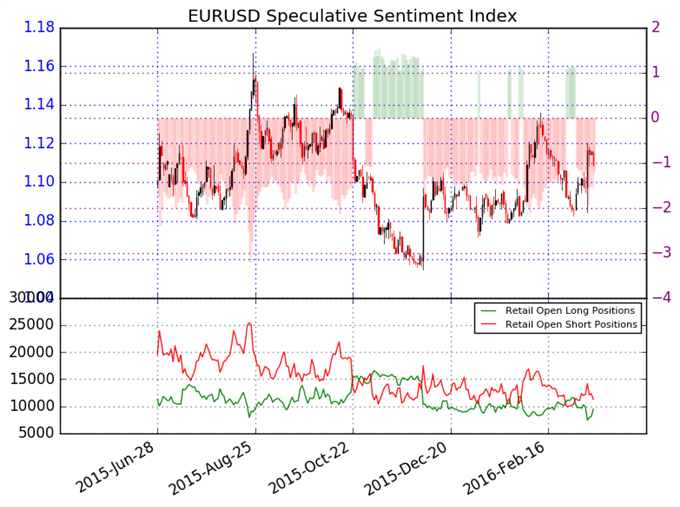

EURUSD – Retail FX traders have most recently sold into Euro/US Dollar strength as it trades near important range highs. Typically we would treat this as a contrarian signal in favor of EUR/USD gains, but indecisive US Dollar price action suggests that ‘the crowd’ may continue to do well in selling at resistance and buying at support.

Past performance is not indicative of future results, but our studies suggest retail traders on aggregate tend to outperform in slow-moving market conditions. Thus an aggressive shift towards selling actually suggests that the Euro may indeed hold below key price resistance levels.

See next currency section: GBPUSD - British Pound Outlook Calls for Further Declines

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX