Why and how do we use the SSI in trading? View our video and download the free trading guide here

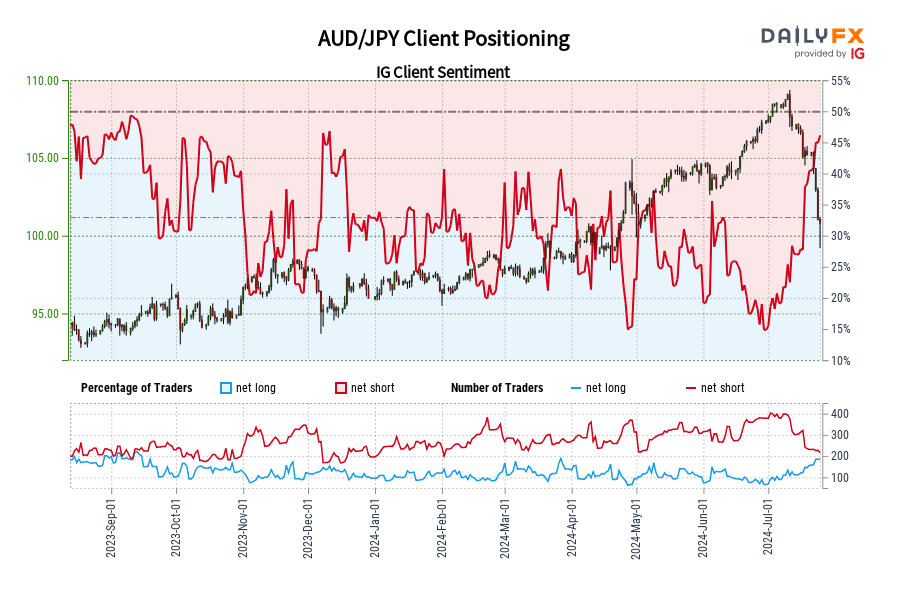

AUDUSD - The ratio of long to short positions in the AUDUSD stands at -1.36 as 42% of traders are long. Yesterday the ratio was -1.30; 43% of open positions were long. Long positions are 1.1% lower than yesterday and 3.3% below levels seen last week. Short positions are 3.0% higher than yesterday and 8.6% above levels seen last week. Open interest is 1.2% higher than yesterday and 6.3% above its monthly average.

We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the AUDUSD may continue higher. The trading crowd has grown further net-short from yesterday and last week. The combination of current sentiment and recent changes gives a further bullish trading bias.