- Gold breakdown underway- risk for price recovery from lower levels in the days ahead

- Check out our 2018 Gold(XAU/USD) projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Gold prices broke below the June opening range last week with the decline now eyeing support targets into fresh 2018 lows. Here are the levels that matter for XAU/USD heading into the close of the week. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

Gold Daily Price Chart (XAU/USD)

Technical Outlook: In last week’s XAU/USD Technical Outlook, we noted that gold prices had stalled at, “1309 before turning just ahead of slope resistance. The 200-day moving average converges on former swing highs / lows at 1307 and a daily close above this level is needed to keep the focus higher.” Gold closed back below the yearly open at 1302 with prices plummeting nearly 2% the following day.

The decline validates a clear break of the monthly opening range keeps the focus on a late-month low in price. Subsequent support objectives are eyed at the 61.8% retracement of the July advance at 1266 backed by the median-line of the descending pitchfork formation (currently ~1256), 1251 and the 50% retracement of the broader 2016 advance at 1244.

New to Forex Trading? Get started with this Free Beginners Guide

Gold 240min Price Chart (XAU/USD)

Notes: A closer look at price action highlights a price reversal off the upper 50-line early in the week with the decline approaching initial targets here at 1266. Note that this level also represents the measured target of the consolidation range break we’ve been tracking since last week. Look for interim resistance at the weekly open at 1279 with the risk lower sub-1285.

It’s worth noting that gold prices are working on a fourth day of consecutive losses- the last time we saw more than four was back September/October of 2016. In that instance, prices were in free-fall with gold dropping nearly 14% over the next three months. Implications suggest the risk for some recovery into the close of the week before resumption.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: The immediate focus is lower while below the weekly open but be on the lookout for a recovery heading into the lower support targets over the next few days. Ultimately a larger rebound would offer more favorable short-entries while within this formation. A breach above the weekly open would put us neutral, with a rally surpassing 1285 risking a move back up towards the upper parallel / 1298-1302.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

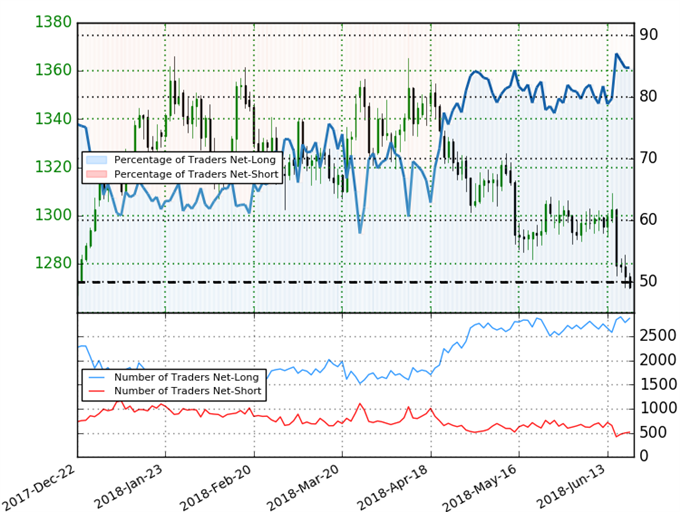

Spot Gold IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +5.57 (84.8% of traders are long) –bearishreading

- Long positions are3.9% higher than yesterday and 4.3% higher from last week

- Short positions are 5.1% higher than yesterday and 22.6% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. However, traders are less net-long than yesterday but more net-long from last week andthe combination of current positioning and recent changes gives us a further mixed Spot Gold trading bias from a sentiment standpoint.

See how shifts in Gold retail positioning are impacting trend- Learn more about sentiment!

---

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- AUD/USD Technical Outlook: Charts Highlight Nearby Price Support

- Dollar at Fresh Yearly Highs– Levels to Know on USD Majors Post-FOMC (Webinar)

- ETH/USD Price Analysis: Ethereum Rebounds from Multi-month Lows

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com

https://www.dailyfx.com/free_guide-new-to-fx.html?ref-author=Boutros