To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

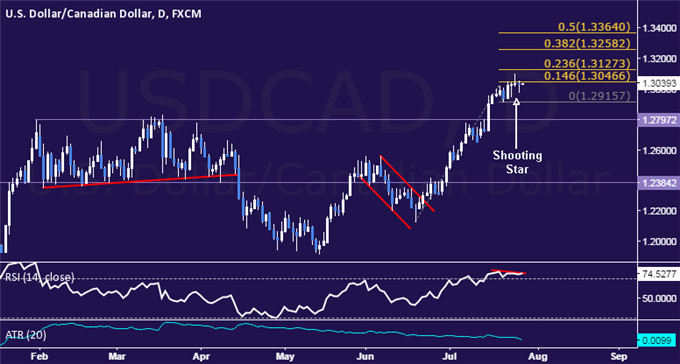

- USD/CAD Technical Strategy: Long at 1.2649

- Support: 1.2916, 1.2797, 1.2696

- Resistance: 1.3047, 1.3127, 1.3258

The US Dollar may be readying to turn lower against its Canadian namesake following the appearance of a Shooting Star candlestick coupled with negative RSI divergence. A daily close below the July 21 lowat 1.2916 exposes resistance-turned-support at 1.2797.Alternatively, a move above the 14.6% Fibonacci expansion at 1.3047 opens the door for a challenge of the 23.6% level at 1.3127.

We entered long USDCAD at 1.2649 and have since taken profit on half of the position. While the Shooting Star candle setup is a worrisome development, confirmation of reversal is absent for now. With that in mind, the remainder of the position will remain in play with a stop-loss adjusted to the breakeven level.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com