Interested In our Analyst’s Longer-Term Dollar Outlook? Be sure to sign up for our free dollar guide here.

Talking Points:

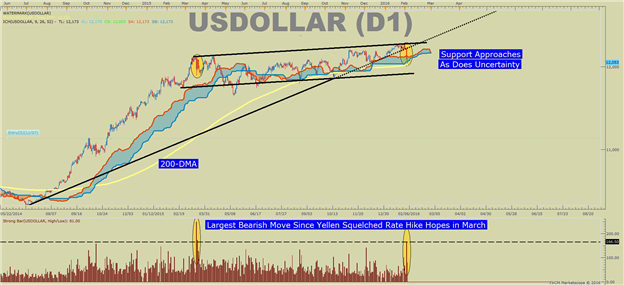

- US Dollar Technical Strategy: Downside Exhaustion Soon To Be Revealed, Buying Dips

- The Lack of Volatility on the Upside Led to a Washout

- Seasonal Tendencies Favor USD Weakness for February, Score one for seasonality

Is everyone all right? It is a pertinent question to ask after a quiet market in G4 FX, aside from negative interest rates à la Bank of Japan and their Japanese Yen whose losses have now been completely erased, were awoken from yesterday's G10 shake-up.

To see how FXCM traders are positioned after such a big move, click here.

What’s odd is that the kick-off to this event was an interview with Federal Reserve Bank of New York President William Dudley noted that financial conditions have tightened since December (not news), which could weight on FOMC. However, the US 2yr Treasury Yield has fallen over the last month to levels that show expectations by the market that the Fed would fight to raise rates once this year.

Second, we had a weak, all right very weak, Non-Manufacturing ISD read yesterday morning, which helped further the US Dollar route. However, the market appears confused due to what currencies were strong yesterday. The Japanese Yen and the highest yielding currencies like Emerging Markets and Commodity Currencies, which are often inversely correlated, both were top performers yesterday.

Such a divergence among top performers (risk-on and risk-off), help to show that the FX market is confused. Either way, the FX market is now in desperate search for a leader. Given the fundamental backdrop, FX will have a hard time looking to the EUR as the March 10 ECB with 100% market expectation of easing as per OIS, and the Yen’s Kuroda re-emphasized this week that they would not stop at -0.1% interest rates if needed.

In other words, let the volatility begin.

Key Levels: Watch the Recent Pivot to Hold

For now, the key support level on the US Dollar has turned quickly to the 200-dma at 12,021. While prior supports have been ripped like a rock dropping through wet paper, the 200-DMA at 12,021 comprises of the Ichimoku cloud and 61.8% Fibonacci retracement of the October-January range.

We recently said in the Dollar Bull Dilemma that short-term weakness was favored, but we were surprised what happened in the short-term. Now, as key support levels are being tested, we could see what the trend is made of in terms of longevity. Unless yesterday’s move was driven by a ‘behind the curtain’ Central Bank move, the market will likely soon favor USD again.

T.Y.