NZD/USD Technical Strategy: FLAT

- New Zealand Dollar down to monthly range support before RBNZ rate decision

- Dominant trend continues to point lower, hinting a bearish breakout is favored

- Renewed directional conviction needed to justify a trade one way or the other

See our free trading guide to help build confidence in your NZD/USD trading strategy !

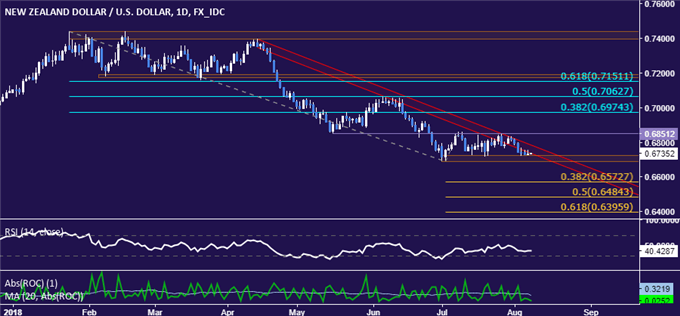

The New Zealand Dollar has dropped to the bottom of monthly range support before the RBNZ monetary policy announcement. The central bank may trigger a breakout marking resumption of the dominant bearish price trend, defined by a series of lower highs and lows set from mid-April.

From here, a daily close below the 0.6688-0.6726 area opens the door for a test of the 38.2% Fibonacci expansion at 0.6573. Alternatively, a push above support-turned-resistance at 0.6851 would invalidate the near-term downside bias and expose the 38.2% Fib retracement at 0.6974.

Prices are too close to support to justify entering short from a risk/reward perspective. On the other hand, taking up the long side without an actionable bullish reversal signal seems premature. Finally, positioning may be critically altered by the RBNZ rate call. With all of that in mind, staying flat seems wise for now.

NZD/USD TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter