EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro bounces vs US Dollar but gains appear to be corrective

- Four-hour chart reveals prices capped by monthly downtrend

- Trader sentiment studies point to firming bearish trend bias

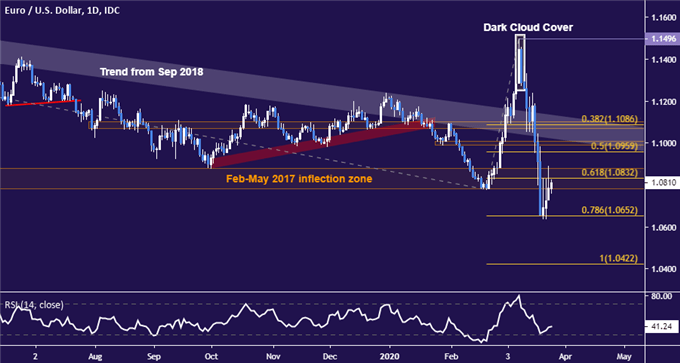

The Euro has launched a tepid recovery against the US Dollar, as expected. Prices pulled up from support at 1.0652, the 78.6% Fibonacci expansion, to challenge former support in the 1.0783-1.0880 zone. This barrier is reinforced by the 61.8% level at 1.0832.

EUR/USD daily chart created with TradingView

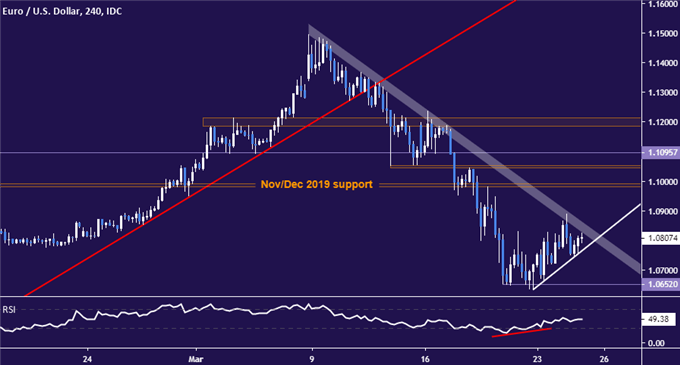

Thus far, the rally appears to be corrective within the context of a broader descent. Indeed, zooming into the four-hour chart reveals EUR/USD remains conspicuously capped by falling trend line resistance defining the descent since the beginning of the month.

Neutralizing near-term selling pressure probably demands a convincing break above this barrier. In this scenario, prices may open the door for a move to challenge support-turned-resistance just below the 1.10 figure. Alternatively, slipping below countertrend support may clear the way back below 1.07.

EUR/USD 4-hour chart created with TradingView

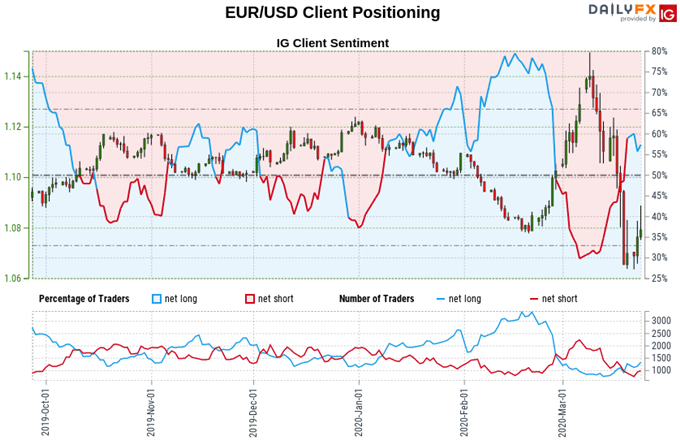

EUR/USD TRADER SENTIMENT

Retail positioning data shows 57.28% of traders are net-long, with the long-to-short ratio at 1.34 to 1. IG Client Sentiment (IGCS) is typically used as a contrarian indicator, so the net-long skew in traders’exposure suggests that EUR/USD is likely to trend downward.

Furthermore, the number of traders net-long is 21.89% higher than yesterday and 33.98% higher from last week.The net-short tally is 6.53% lower than the prior session and 11.26% from a week before. Taken together, recent changes in positioning make for a stronger sentiment-derived bearish signal.

See the full IGCS sentiment report here.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter