ASX 200 Technical Analysis Talking Points:

- Global risk appetite continues to drive the index fundamentally

- Technically retracement support has held once more

- However it may not survive another test

Find out what retail foreign exchange traders make of the Australian Dollar’s chances right now at the DailyFX Sentiment Page.

ASX investors have again been shown the value of Fibonacci retracement as a key level from that series has been revealed as important support yet again.

The Australian stock benchmark has of course been buffeted as have all global assets by the vicissitudes of trade headlines flying between Washington and Beijing. As Tuesday’s trade gets going, hostility seems to have been replaced with a more hopeful backdrop but the situation is obviously fluid which means risk appetite must be too.

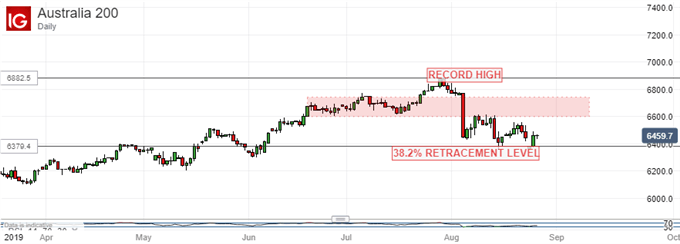

The ASX 200’s slide was arrested on the daily chart by 6379. That support is the second, 38.2% Fibonacci retracement of the rise up to July’s record high form the 2019 low of January 6. The level continues to be important having held the bears in check in early August and again towards mid-month.

Still, the Sydney stock benchmark remains well below the long-dominant uptrend which was finally and conclusively shattered by the sharp slide of August 5. More seriously the bulls probably don’t have long to force a new ‘higher high’ above August 22’s intraday peak of 6561 which now stands out as near-term resistance to beat.

They probably need to get this done by week’s end at the latest if the month of August isn’t to start on a sour note. If they can’t then that Fibonacci support level will come into sharp focus once again and, framed by a succession of lower highs it’s unlikely to survive another test.

A break would bring support from mid-May to early June into play. That comes in between 6303 and 6196.

The bulls don’t have long to nail down that higher high above last week’s top if they’re to avoid this scenario.

ASX 200 Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!