Gold (XAU) Price Weekly Technical Analysis

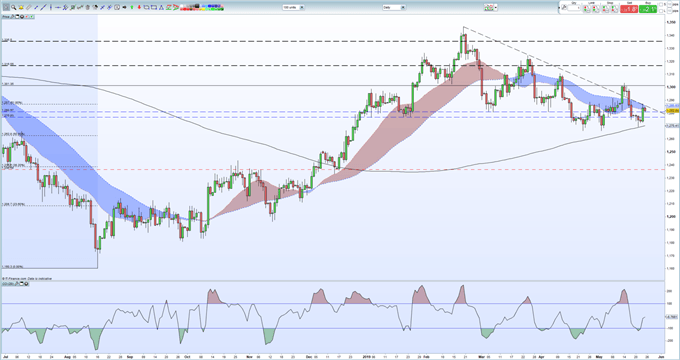

- Gold remains in a three-month downtrend with lower highs prominent.

- Supportive 200-day moving average continues to move higher, trapping gold.

- DailyFX Q2 Forecasts and Top 2019 Trading Opportunities.

Gold Price – Is a Short-Term Rebound Building?

The medium-term technical outlook for gold remains for lower prices but within this pattern of lower highs, a short-term move higher cannot be discounted as technical indicators look set to collide. It is likely that a fundamental driver will be in charge of the next move with US-China trade wars, US-Iran tensions and ongoing global growth concerns the likely culprits. Gold has yet to move markedly to increased market risk seen this week, leaving room for a sharp ‘catch-up’ move.

Since February 20, gold has carved out a series four lower highs – the last one at $1,303.6/oz. weighing on the precious metal. This bearish pattern, while still intact, is in danger of being negated as the pattern of lower lows has been broken twice recently, albeit marginally. This combination is now trapping gold in a tightening range where other technical indicators also come into play. To the immediate upside, the downtrend and the 20- and 50-day moving averages converge between $1,282/oz and $1,286/oz. providing short-term resistance just ahead of 61.8% Fibonacci retracement at $1,287/oz. A break and close above this cluster may suggest that gold attempts to test the tight $1,301 - $1,304/oz. range. If gold closes above here, the pattern of lower highs is broken and may add to further bullish sentiment.

A tight cluster of old support levels between $1,281 and $1,276.8/oz. guards the 200-day moving average, currently at $1,270.4/oz. and trending higher. This long-term ma has already been tested and held firm at a slightly lower level on Tuesday this week. A break and close below opens the path to the 50% Fibonacci retracement level at $1,262.8/oz.

Gold (XAU) Daily Price Chart (July 2018 – May 24, 2019)

How to Trade Gold: Top Gold Trading Strategies and Tips

Trading the Gold-Silver Ratio: Strategies and Tips.

IG Client Sentiment shows that retail traders are 78.8% net-long gold, a bearish contrarian indicator. Recent daily and weekly sentiment shifts however give us a mixed trading bias.

--- Written by Nick Cawley, Market Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1