Talking Points

- Just a minor recovery or something more in Gold?

- USD/JPY rebounds off key Gann level

- AUD/USD consolidates below important resistance

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

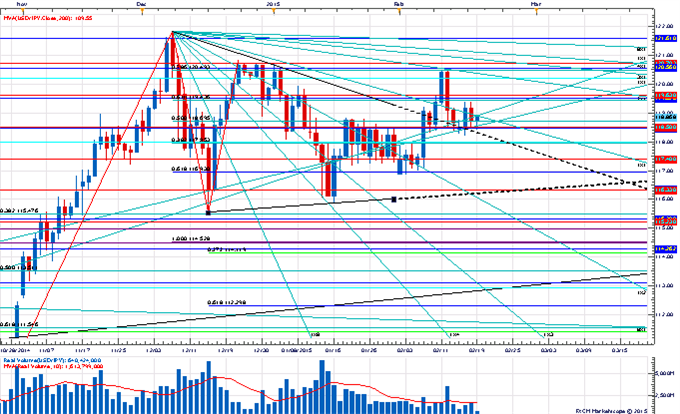

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY remains in consolidation mode above the 3rd square root relationship of the 2014 high near 118.40

- Our near-term trend bias remains positive while above 118.40

- Interim resistance is seen around 119.65, but a move through 120.80 is really needed to signal that a more meaningful extension higher is underway

- A minor turn window is eyed early next week

- A close below 118.40 would turn us negative on the exchange rate

USD/JPY Strategy: Like the long side while 118.40 holds.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 117.95 | *118.40 | 118.85 | 119.00 | *119.65 |

Price & Time Analysis: AUD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- AUD/USD remains in consolidation mode below the 3rd square root relationship of the year’s low at .7885

- Our near-term trend bias is negative while below .7885

- The year’s closing low around .7715 remains a key downside pivot with weakness below needed to signal a resumption of the broader trend

- A very minor turn window is seen tomorrow

- A close above .7885 would turn us positive on the Aussie

AUD/USD Strategy: Like the short side while below .7885

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| AUD/USD | *.7715 | .7740 | .7790 | .7840 | *.7885 |

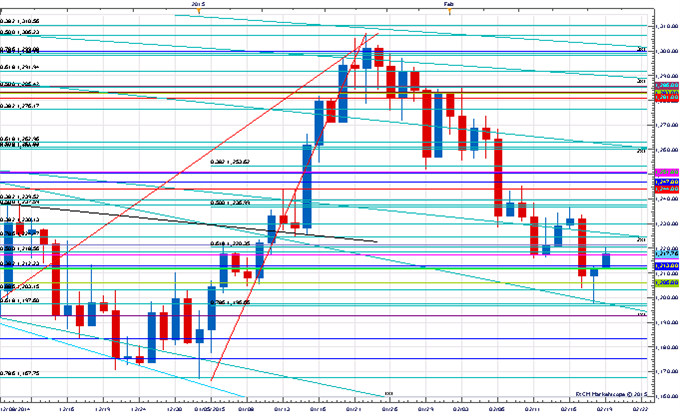

Focus Chart of the Day: GOLD

We are still waiting to see how the timing relationships we mentioned earlier this week are going to play out. The euro is starting to show signs of stalling out while Cable remains pretty bid. How we close the week out should help clear up the cyclical/technical picture and give us some directional clarity. Another market worth watching closely here is Gold. It has a similar cyclical set up as that of the European currencies and actually might be leading by a day or so. On Wednesday the metal found support where it needed to with a reversal occurring just a bit under 1200 dollars an ounce at a convergence of the 78.6% retracement of the year-to-date range and the 1x1 Gann angle line of the 2013 closing high. A move through 1236 is now needed to confirm that a more meaningful push higher is underway. Weakness below 1197 would invalidate the burgeoning positive cyclicality and re-focus lower.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX