Gold, Japanese Yen, GBP/USD Analysis & News

- Gold Trading as Risk Asset as Opposed to a Safe-Haven

- Japanese Yen Returns to Familiar Correlation

- GBP/USD Reducing Sensitivity to Stocks

Gold Trading as Risk Asset as Opposed to a Safe-Haven

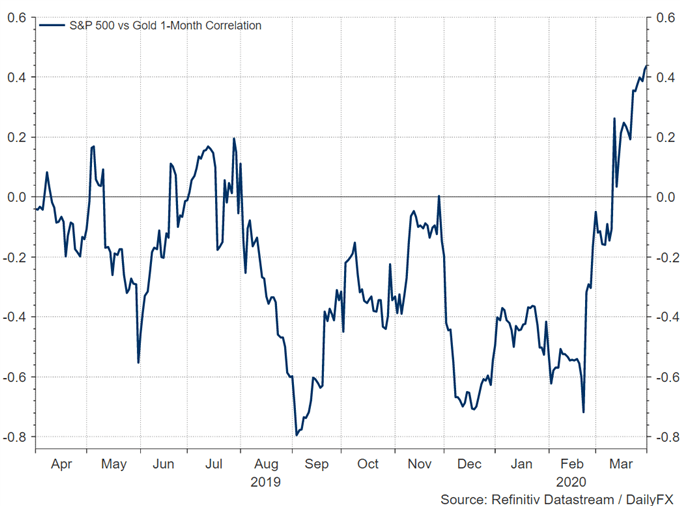

In recent weeks, gold prices have been trading as a risk asset as opposed to a safe-haven with the 1-month correlation between S&P 500 and gold swinging from a negative to positive (Figure 1). Consequently, we questioned whether gold was losing its safe-haven status as investors deleveraged made a dash for cash. That said, we see gold behaving as a liquidity haven, in which further monetary stimulus measures are having a greater impact on prices as opposed to risk appetite with the continued move lower in bond yields providing a floor for gold. As such, we retain a bullish outlook in the long term for gold prices with a run-up $1700. In the short term, we are cognizant of efforts to suppress the move higher in gold in light of strong physical demand such as the CME raising margin requirements, alongside slowing demand from emerging market central banks.

Figure 1. Gold Trading as a Risk Asset

Japanese Yen Returns to Familiar Correlation

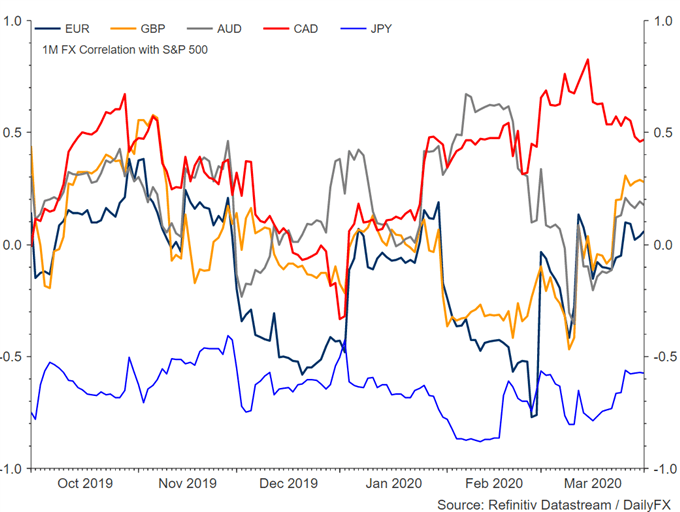

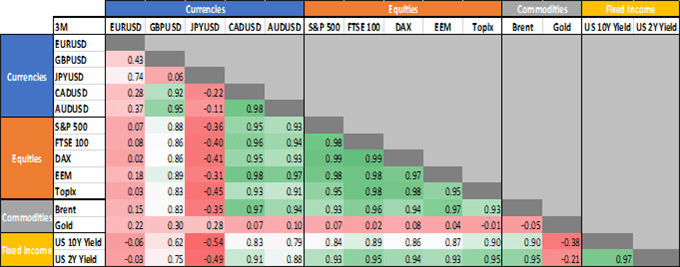

In our previous note, we had highlighted that the Pound had become increasingly sensitive to risk assets with the currency particularly vulnerable during times of market liquidation, given that UK needs constant inflows amid its large current account deficit. However, with recent actions by the Federal Reserve addressing Dollar funding issues with GBP 3-month cross-currency basis swaps flipping to positive, the impact of souring risk appetite on the Pound has subsequently diminished. In turn, reducing the downside in the Pound during times of risk-off. Alongside this, the Japanese Yen appears to have returned back to its familiar correlation with risk appetite as 1W correlations show an increasingly negative relationship following the Japanese fiscal year-end. As such, given that risks remain skewed to the downside for equity markets, Japanese Yen looks in good shape to strengthen further. US Equities to revisit the lows?

Figure 2. FX Correlation with Stocks

How to Invest During a Recession: Investments & Strategy

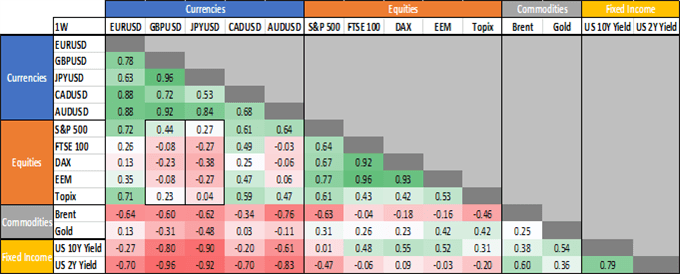

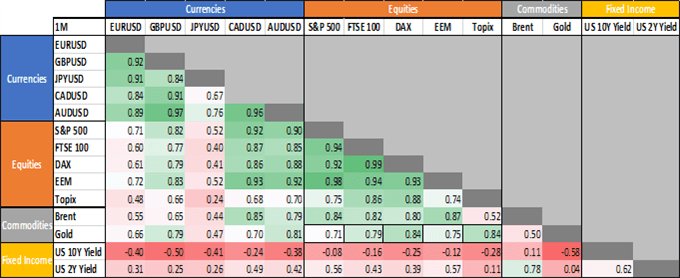

Cross-Asset Correlation Matrix(1 Week, 1 Month & 3 Month Timeframe)

Source: Refinitiv, DailyFX. The Topix is used a proxy for the Nikkei 225.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX