USD/JPY News and Analysis

- Japan faced with solo intervention to stem rising USD/JPY as G7 nations monitor spillover effects of a strong dollar

- USD/JPY slightly softer but remains elevated as the pair looks on track to reach the 150 level

Lack of G7 Coordination to Stem the Rampant Dollar Leaves Japan with Limited Options

The yen continues to decline in value against the high-flying dollar, with the latest surge higher coming off the back of the G7 meeting last week where spillover effects of the dollar were discussed but crucially there was no mention of a coordinated intervention – leaving Japan with solo intervention and continued ‘jawboning’ as its most likely responses.

The yen’s decline follows on from a typical ‘carry trade’, a process that seeks to benefit from borrowing lower yielding currencies like the yen to invest in higher yielding currencies like the dollar. As long as the Fed continues to hike interest rates aggressively and the Bank of Japan (BoJ) continues to cap its own interest rates (to stimulate a historically deflationary economy) the imbalance is set to persist. As far as changing its ultra-dovish monetary policy stance, the BoJ’s Wakatabe mentioned last week that the Bank would like to see inflation stabilized at 2% in the longer-term before thinking about a change in policy stance. Upcoming Japanese inflation data on Friday will provide a clearer indication of whether the 2% goal is heading in the right direction.

Customize and filter live economic data via our DaliyFX economic calendar

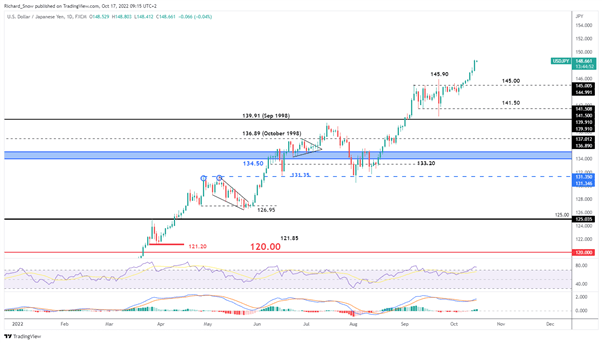

USD/JPY Technical Considerations

The first round of Japanese FX intervention of the 21st century took place on September the 22nd, and while it drastically lowered USD/JPY, the effects weren’t long lasting. On October the 11th price action broke above the September 22nd high of just below 146 and continues higher. Friday’s advance towards 149 has many wondering if the next phase of intervention is imminent as the pair trades only slightly lower than last week’s high. Japan has stated that volatile one-sided moves are the issue but there will certainly be concern over the actual level of the exchange rate.

149 remains a crucial level for near-term price action and then the 150 psychological level. The RSI remains in overbought territory however, pullbacks have proven to be short-lived even if we do see a reasonable move lower on talk of possible intervention – which may be implemented during periods of lower liquidity. For now, the trend remains to the upside as it appears markets are happy to test Japan’s resolve. Support comes in at the prior high of 147.69

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

The 4-hour chart reveals what appears to be a ‘bull flag’ – a typically bullish formation. However, the longer USD/JPY trends higher, the likelihood of intervention increases meaning risk management becomes ever more important in a trend following strategy at these extreme levels.

USD/JPY 4-Hour Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX