GBP, UK Mini Budget, Kwasi Kwarteng, Bank of England, US Federal Reserve—Talking Points

- The Pound remains very much the loser in developed markets’ ugly contest.

- A new multi-billion-pound package of tax cuts and energy subsidies failed to lift it.

- Near-term prospects for the currency look bleak, both fundamentally and technically.

The Pound fell to a fresh 37-year low against the US Dollar early Friday and failed to recover much ground after the new British finance minister unveiled a hefty program of energy subsidies and tax cuts.

The general strength of the greenback, rooted in an aggressive US Federal Reserve with more room and ability to raise interest rates than most, has weighed on all major currencies this year. But the Pound has been especially hard-hit thanks to rampant inflation and flatlining growth. Chancellor of the Exchequer Kwasi Kwarteng’s ‘mini budget’ is aimed at tackling both, with a GBP105 billion (USD116 billion) package. However, even that was not enough to dispel the darkness over sterling.

GBP Assets Viewed More Warily

Reuters reported that fully 55% of international banks and research consultancies it polled last week said there was a ‘high risk’ that confidence in British assets would deteriorate sharply over the next calendar quarter.

The Bank of England announced its seventh interest-rate increase in less than twelve months on Thursday, despite forecasting recession, as the UK faces the highest inflationary burden of any economy within the Group of Seven. However, its half-basis point increase was weaker than that enacted by the Fed, and Credit Suisse predicted that this restricted ability to act would see GBP/USD fall further, to slide below the $1.10 handle.

IG’s own client sentiment index offers just a crumb of comfort for GBP/USD bulls. It shows perhaps a general feeling that the Pound might just have suffered enough for the moment, with 83% of respondents now bullish on the pair. This is unlikely to be a particularly resilient vote of confidence, however, merely a suggestion that Sterling’s hammering may have gone far enough for now.

GBP/USD Technical Analysis

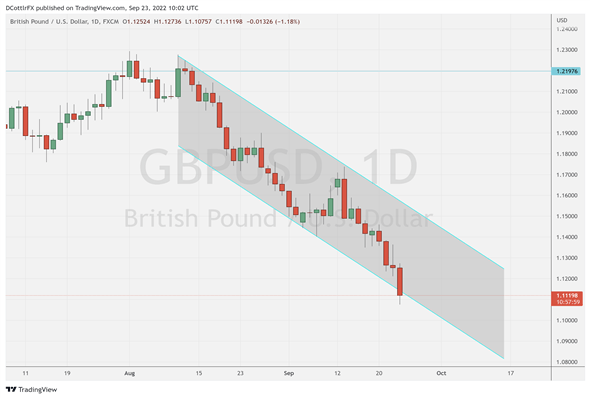

The Pound may be on the verge of yet another leg lower as the downtrend channel from August 10 is in clear danger of failing to the downside on a weekly closing basis. That channel itself is merely an extension of the long slide seen since June, 2021, and came into force following the modest bullish fightback seen between July and August of this year.

GBP/USD Daily Chart Prepared by David Cottle Using TradingView.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

However, it has been dominant since and a break here could be a sign of more severe falls for the Pound, already at levels not seen since 1985. The channel base will come in on Friday at $1.11456. The fundamental data calendar is fairly light, although the US Purchasing Managers Index data for September could provide trade direction in the European afternoon. With the market so close to that key level, sterling looks set to remain under considerable pressure. In the near term, bulls will probably need to regain resistance levels around $1.14885, where the market found a very temporary base last week. That’s clearly a very big ask.

-By David Cottle for DailyFX