AUD/USD, China GDP, Industrial Production, Retail Sales, Stimulus - Talking Points

- Australian Dollar sees delayed upside reaction on Chinese data dump

- China’s second-quarter GDP growth misses estimates at 0.4% y/y

- AUD/USD moves higher, taking aim at Falling Wedge support

AUD/USD is modestly higher after China reported a second-quarter gross domestic product (GDP) growth rate of 0.4% y/y, missing the 1.0% forecast. The growth slowdown is attributable to Covid restrictions that shuttered factories and kept people confined to their homes from March through May. A beaten-down property sector is another headwind to the Chinese economy, and homebuyers are reportedly refusing to pay mortgages across more than a dozen cities.

The slowdown in the world’s second-largest economy may lead to downgrades in global growth forecasts. The International Monetary Fund’s World Economic Outlook is due for an update on July 26. In its April update, China is forecasted to grow at 4.4% for 2022, which is well below the 5.5% target China is aiming for. Copper and iron ore prices are down more than 20% since May.

Beijing likely needs to open the tap on stimulus measures to support growth. Local governments are under pressure to increase special bond sales for infrastructure projects, a move that may underpin falling metal prices. Chinese policymakers appear focused on increasing the supply of credit rather than lowering rates. This morning, the 1-year medium-term lending facility rate was kept unchanged at 2.85%.

There were signs of recovery in the June data. Industrial production rose to a 3.9% y/y pace in June, up from 0.7% in May. June retail sales climbed 3.1% y/y, up from -6.7% and beating the 0.3% consensus forecast. If China takes a more relaxed and targeted approach to contain Covid outbreaks and stimulus measures increase, then a third-quarter rebound is a likely scenario to forecast. That may explain the upside reaction in the Australian Dollar.

AUD/USD Technical Outlook

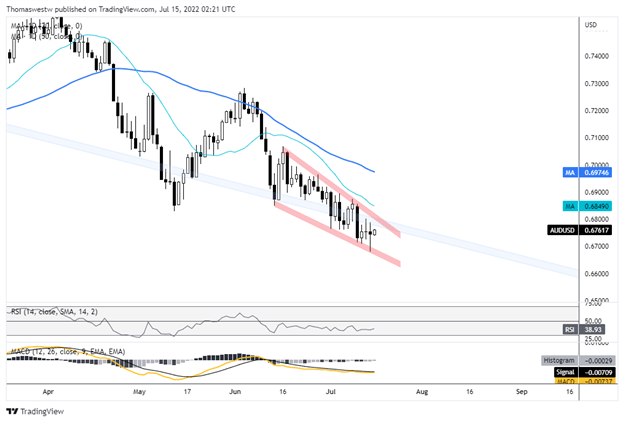

AUD/USD is up around a quarter of a percent after a volatile overnight session. Prices are nearing wedge resistance, which overlaps a trendline from the December 2021 swing high. A break above resistance would see the 20-day Simple Moving Average shift into focus.

AUD/USD Daily Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter