Canadian Inflation Data - Talking Points

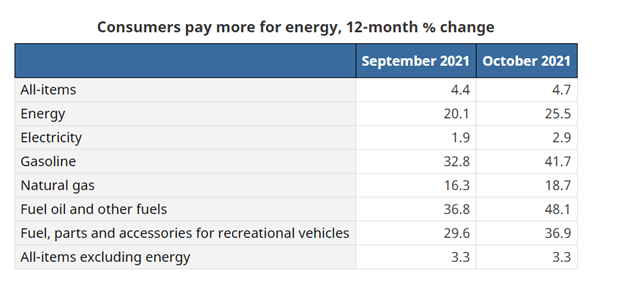

- Canadian CPI data meets expectations at 4.7% (YoY), up from 4.4% for Sep

- Energy prices remain the key catalysts for rising prices

- USD/CAD climbs upon the release of the data

The Consumer Price Index (CPI) rose 4.7% on a year-over-year basis in October, up from a 4.4% increase in September. This was the largest gain since February 2003. Excluding energy, the CPI rose 3.3% year over year, matching the increase in September.

On a monthly basis, the CPI rose 0.7% in October, the largest gain since June 2020 (+0.8%), when energy prices began to recover following steep declines during the early months of the pandemic. On a seasonally adjusted monthly basis, the CPI rose 0.5%.

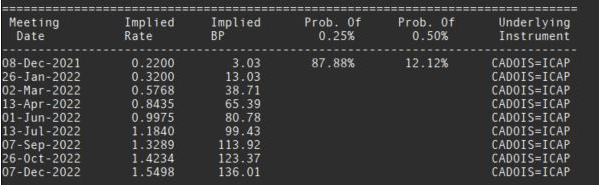

With BoC governor Tiff Macklem suggesting that higher rates may be on the cards, a total of five 0.25% are now expected to occur throughout next year.

DailyFX Economic Calendar

Source: Refinitiv

Visit the DailyFX Educational Center to discover how CPI data affects currency pairs

With energy prices contributing to the largest increase in prices, supply constraints will likely continue to weigh on consumers for the foreseeable future.

Source: Statistics Canada

Upon release of the data, USD/CAD climbed higher as investors digested the softer than expected print.

If expectations of rate hikes continue to decline, the Loonie may continue to surrender to a stronger greenback.

USD/CAD 5 Min Chart

Chart prepared by Tammy Da Costa using TradingView

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707