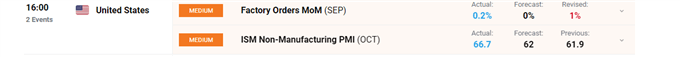

ISM Services Data Posts Massive Positive Surprise

ISM services data posted a strong number (66.7) as business activity, new orders and export figures impress. Employment however, looks to be lagging.

For all market-moving data releases and events see the DailyFX Economic Calendar

‘Services’ is the largest sector in the US economic landscape and provides an indication of current economic activity. Reading of 50 and above indicate an expansion while readings below 50 indicate a contraction in the sector.

Why this Reading of ISM Services is of Particular Importance

Global markets eagerly await the FOMC statement later today with Fed chair, Jerome Powell set to provide more specifics around the nature and timing of the highly anticipated tapering of its monthly asset purchases. The Fed’s dual mandate focuses on the employment and inflation, two sub-categories included in the overall ISM reading.

The inflation or ‘prices’ element is trending much higher than the employment reading with a reading of 82.9 versus a lower move on the employment front of 51.6, down from 53.0. This pretty much confirms what we have been seeing in the broader market with inflationary pressures proving more resilient than the labor market. We will have more information on the state of the labor market on Friday when the NFP data is released with a current expectation of an additional 450k jobs being added to last month’s disappointing 190k addition.

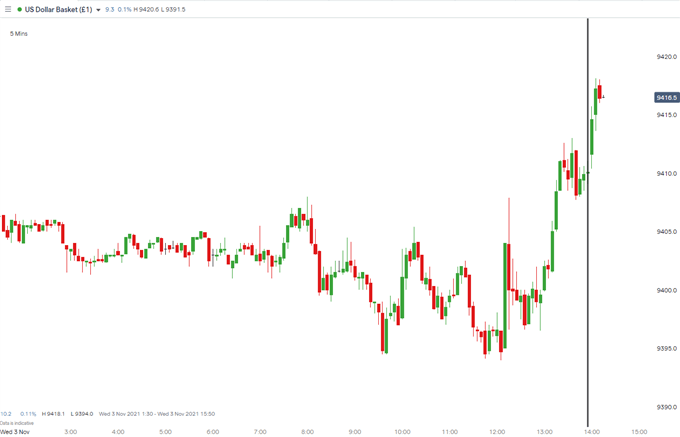

Dollar Response (US Dollar Index, DXY)

The initial response has been dollar positive as the DXY continued to trade slightly higher, in line with price action in the hour before the release.

DXY 5 Minute Chart

Chart prepared by Richard Snow, IG

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX