Nasdaq 100, Nikkei 225, US Debt Ceiling, NFPs, Technical Analysis – Asia Pacific Indices Briefing

- Nasdaq 100, S&P 500, Dow Jones gain as temporary debt ceiling increase looks likely

- Treasury yields rose, may continue climbing ahead of Friday’s non-farm payrolls data

- Nikkei 225 may take a break from aggressive losses, eyeing the floor of a rectangle

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Wednesday’s Wall Street Trading Session Recap

US equities pulled off a rather rosy session, with the Nasdaq 100, S&P 500 and Dow Jones rising 0.71%, 0.46% and 0.32% respectively. Most of the gains occurred during the latter half of the session when reports crossed the wires that Senate Minority Leader Mitch McConnell offered Democrats an option to temporarily end the debt limit impasse until later in December.

That cooled US debt default woes for now, which have likely been contributing to the recent rise in market volatility. This is likely a temporary issue, more importantly, Treasury yields were also on the rise. In fact, they have been ever since last month’s Federal Reserve interest rate decision. As risks of a US debt default moves past markets, traders may start focusing back on monetary policy.

As such, bond yields may continue aiming higher as Friday’s non-farm payrolls report nears. That is the key event risk at the end of the week. Another materially softer jobs report may curtail the pace at which investors think that the central bank will taper asset purchases and eventually raise benchmark lending rates.

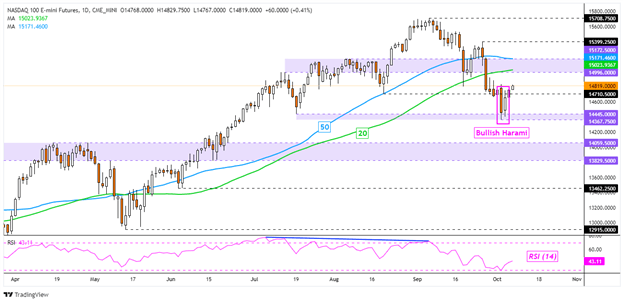

Nasdaq 100 Technical Analysis

The Nasdaq 100 may ready to reverse recent losses after prices confirmed a Bullish Harami candlestick pattern. This also followed a test of the 14367 – 14445 support zone. That has exposed the 14996 – 15172 inflection zone. Still, the index remains under both the 20- and 50-day Simple Moving Averages. These may come into play as resistance, pivoting the Nasdaq lower.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Daniel Dubrovsky

Nasdaq 100 – Daily Chart

Thursday’s Asia Pacific Trading Session

Futures tracking Wall Street are pointing higher heading into Thursday’s Asia-Pacific trading session. That could point to a fairly upbeat session for risk appetite. Mitch McConnel did note that he can’t predict if a deal will be stuck tonight on a temporary debt ceiling increase. Still, he added that a vote is possible on it over the next 24 hours.

The economic calendar is fairly light during the APAC session, which places the focus on general market sentiment. This could give the Nikkei 225 some breathing space as it heads for the worst 2-week performance since March 2020. Traders are likely fading expectations of more fiscal stimulus in the aftermath of Suga’s step down. Fumio Kishida, who is set to become Japan’s 100th prime minister, is likely seen as more of the status quo.

Trading Strategies and Risk Management

Global Macro

Recommended by Daniel Dubrovsky

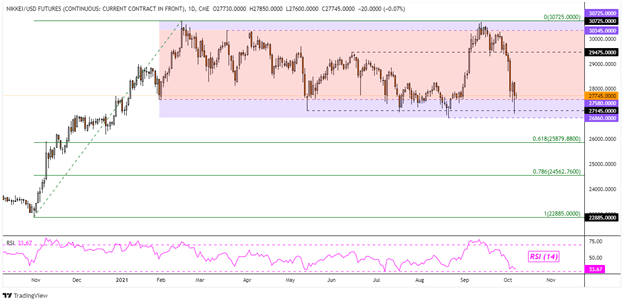

Nikkei 225 Technical Analysis

The Nikkei 225 continues to consolidate within a rectangular chart formation. Following a rejection of the ceiling at 30345 – 30725, prices dived towards the floor. The latter appears to be a range of support between 26860 and 27580. This could open the door to another bounce, extending the consolidation within the rectangle. Otherwise, a breakout lower exposes the 61.8% Fibonacci retracement at 25879.

Nikkei 225 – Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter