AUSTRALIAN DOLLAR OUTLOOK: AUD/USD EYES RBA DECISION ON DECK

- Australian Dollar front and center headed into upcoming RBA rate decision

- AUD/USD implied volatility was just clocked at 10.4% for the overnight tenor

- The Reserve Bank of Australia might decide to forge ahead with tapering QE

The Australian Dollar advanced slightly during Monday’s trading session with AUD/USD closing 16-pips higher on balance. Aussie bulls drove the major currency pair up 0.5% at its intraday high, but gains were pared as market sentiment softened broadly. The US Dollar also seemed to catch an afternoon bid following some relatively hawkish comments from Fed Governor Christopher Waller.

AUD/USD price action now shifts focus to high-impact event risk posed by the upcoming RBA decision. The Reserve Bank of Australia is scheduled to provide an update Tuesday, 03 August at 04:30 GMT. Though the central bank is widely expected to leave monetary policy unchanged, volatility could accelerate if tweaks are made to the current timeline for tapering asset purchases.

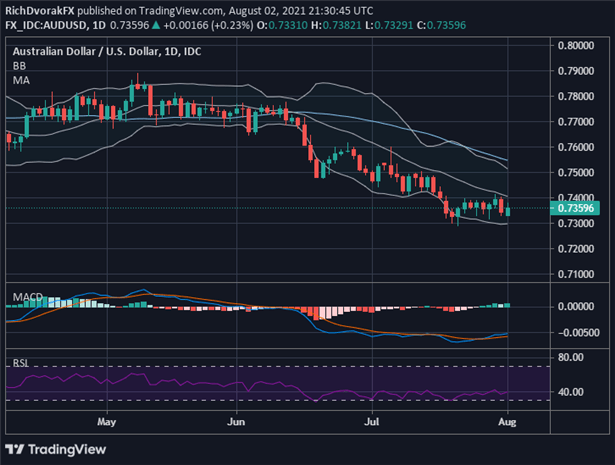

AUD/USD PRICE CHART: DAILY TIME FRAME (09 APRIL TO 02 AUGUST 2021)

Chart by @RichDvorakFX created using TradingView

In fact, overnight implied volatility for AUD/USD just jumped to 10.4%. This compares to its 20-day average reading of 8.5% and ranks in the top 70th percentile of measurements taken over the last 12 months. That seems relatively low for an RBA rate decision, however, and could suggest markets see the central bank forging ahead with plans to taper QE next month. On the other hand, in light of recent lockdowns and downside risks stemming from the delta variant of covid, there is potential that RBA guidance is shifted to reflect a tapering delay.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

The latter scenario would likely be bearish for the Australian Dollar and AUD/USD price action. This might see the Aussie weaken back down to July swing lows around the 0.7300-handle. Conversely, the Australian Dollar could push higher if the RBA stands pat on its QE taper timeline. That could see AUD/USD bulls eye the 20-day simple moving average as nearside resistance. Eclipsing this technical obstacle likely opens the door to the upper Bollinger Band near the 0.7500-price level.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight