Nasdaq 100 Price Forecast:

- The Nasdaq 100 ticked higher following the July FOMC rate decision as equities look to enjoy a continued accommodative backdrop

- Elsewhere, strong technology earnings have helped justify current valuations

- Market participants may now turn their focus to the upcoming stream of earnings report for further influence

Nasdaq 100 Ticks Higher Following FOMC Rate Decision, Powell Presser

The Nasdaq 100 is on pace to close Wednesday trading slightly higher, despite a FOMC event that sparked USD strength – generally an indication of a hawkish lean. While initial takeaways and price action are largely mixed, there was little in the meeting or subsequent press conference to suggest the backdrop equities have enjoyed for more than a year will suddenly change for the worse. That said, the Nasdaq 100, Dow Jones and S&P 500 may look to continue their upward climb in the weeks to come.

To that end, price action may enjoy progress relative to recent sessions now that the major event risk has passed and traders can look to upcoming earnings for future catalysts. Further still, recent earnings suggest large technology stocks might continue their streak of dominance as Microsoft, Apple and Google revealed remarkable quarterly results after Tuesday trade. Together the continued monetary policy backdrop and strong earnings equip the Nasdaq 100 with a strong fundamental backing headed into August.

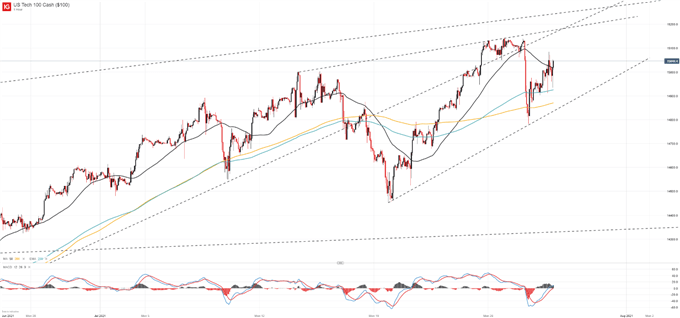

Nasdaq 100 Price Chart: 1 - Hour Time Frame (June 2021 – July 2021)

From a technical perspective, initial resistance may reside along the index’s recent record high just shy of 15,150 where a collection of rising trendlines intersect. Should risk appetite dwindle and price reverse lower, early support may be derived from the trendline projection rising of the index’s July 19 swing low although the level has not yet been verified.

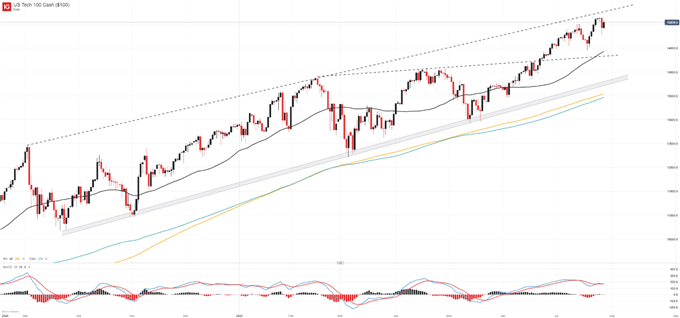

Nasdaq 100 Price Chart: Daily Time Frame (August 2020 – July 2021)

Over the longer term, the Nasdaq 100 trades near the topside of an ascending channel that has helped guide the index higher since September and might offer considerable support toward the lower side of the range. That said, a move toward the lower end of the channel would constitute a significant technical development and a reassessment of the landscape might be required at such a time. Until such a break occurs, however, the Nasdaq 100 may enjoy a modest tailwind in the weeks ahead. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX