USD/JPY PRICE OUTLOOK: USD/JPY SEARCHES FOR SUPPORT AHEAD OF FED DECISION

- USD/JPY price action has weakened sharply on the session but is searching for support

- The US Dollar remains focused on event risk posed by tomorrow’s Fed rate decision

- Overall solid consumer confidence data might help USD/JPY bounce off intraday lows

- Bookmark and revisit our Real Time News page for breaking news and analysis

US Dollar price action is trading fairly mixed on the session so far with the broader DXY Index little changed. USD/JPY is notably weaker, however, with the plunge in real yields to new record lows weighing negatively on the major currency pair. This likely follows lingering market angst surrounding the delta covid variant and deteriorating outlook for long-term economic growth.

The US Dollar and real yields might be facing downward pressure due to changes in positioning ahead of Wednesday’s Fed rate decision as well. That said, the latest round of consumer confidence data just released is setting the table for high-impact event risk posed by the Federal Reserve tomorrow.

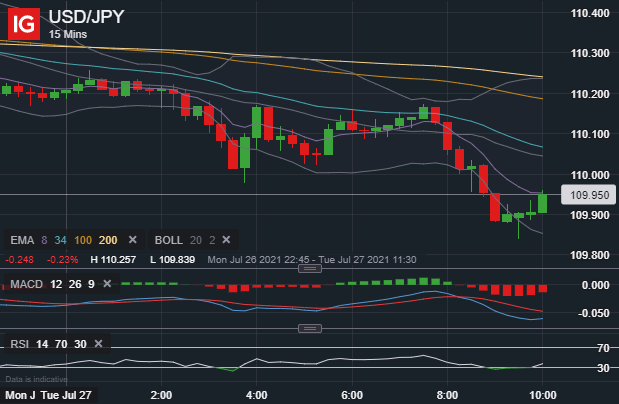

USD/JPY PRICE CHART: 15-MINUTE TIME FRAME (27 JULY 2021 INTRADAY)

Headline consumer confidence improved for the sixth consecutive month to 129.1 in July. This topped the market forecast of 123.9 and compares to the prior reading of 127.3 in June. The present situation and future expectations sub-components both ticked higher to 160.3 and 108.4, respectively. According to the consumer confidence report, short-term inflation expectations increased. This had little impact on consumer purchasing intentions, though, with the proportion of consumers planning to purchase homes, automobiles, and major appliances all rising alongside vacation intentions.

Consumers also saw an improvement in business conditions and the labor market. This all stands to drive consumer spending and economic activity in the short-term. As such, overall solid consumer confidence data might help USD/JPY price action find some support around the 109.90-level and intraday lows. The Dollar-Yen is nevertheless vulnerable to a bearish trend that has developed since last Friday’s peak. Not to mention, in the grand scheme of things, USD/JPY price action likely cares more about market sentiment, real yields, and the outcome of tomorrow’s Fed meeting than the consumer confidence index.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight