S&P 500, NIKKEI 225, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 closed +0.13%, +0.12%, and +0.17% respectively

- Jerome Powell reiterated his dovish stance when speaking to the House of Financial Service Committee

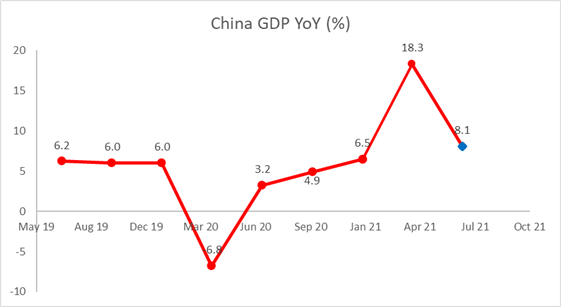

- China’s Q2 GDP is expected at 8.1% YoY, which will set the tone for APAC trading

Powell Testimony, China GDP, Earnings, Yields, USD, Asia-Pacific at Open:

Wall Street stocks climbed after Fed Chair Jerome Powell reiterated his dovish stance in a semiannual monetary policy report to the Congress. He said that the economy’s progress is still a ways off to reaching the standard of ‘substantial further progress’, and the labor market in particular is still well below pre-Covid levels. Therefore, the central bank may continue its current pace of asset purchase and will be patient in tightening monetary stimulus.

The US Dollar fell alongside Treasury yields after his speech, which soothed tapering fears after Tuesday’s core CPI data stoked inflation concerns. Yet, tapering will remain a key market theme in the months to come. Yesterday, both the RBNZ and BoC announced a scaling back their pandemic-era asset purchases this month as the economic recovery gathers pace.

US earnings season kicked off with an upbeat tone, with results from Morgan Stanley, Goldman Sachs, Bank of America, Wells Fargo and Citigroup all topping analysts’ estimates. Market reactions were somewhat mixed however, reflecting that traders were perhaps “buying expectations, and selling facts”.

Looking ahead, China’s Q2 GDP figure heads today’s economic docket alongside Australia’s jobs report and US weekly initial jobless claims data. Asian investors will monitor closely the growth rate of the world’s second-largest economy for clues about its recovery. The recent RRR cut signaled that more liquidity is needed for small and medium enterprises to withstand rising raw material prices. Find out more from DailyFX economic calendar.

China GDP (YoY) - Forecast

Source: Bloomberg, DailyFX

Asia-Pacific markets are mixed at the beginning of Thursday’s trading session. Futures in Japan, mainland China, Hong Kong, South Korea, Singapore, Malaysia and Thailand are in the red, whereas those in Australia, Taiwan and India are in the green.

Japan’s Nikkei 225 index looks set to extend lower after falling 0.38% on Wednesday. Stocks in Tokyo are under selling pressure as investors mull gains in new coronavirus cases in Japan caused by the Delta variant of the Covid-19 virus. A stronger Japanese Yen may also weigh on stocks as it makes the country's exports more expensive to overseas buyers.

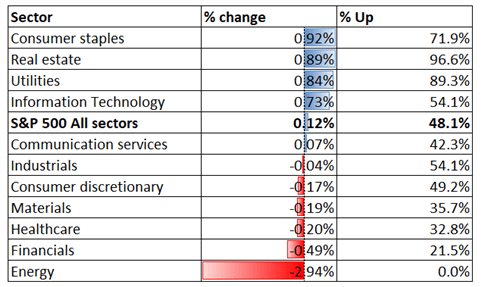

Looking back to Wednesday’s close, 5 out of 11 S&P 500 sectors ended higher, with 48.1% of the index’s constituents closing in the green. Consumer staples (+0.92%), real estate (+0.89%) and utilities (+0.84%) were among the best performers, whereas energy (-2.94%) lagged behind.

S&P 500 Sector Performance 14-07-2021

Source: Bloomberg, DailyFX

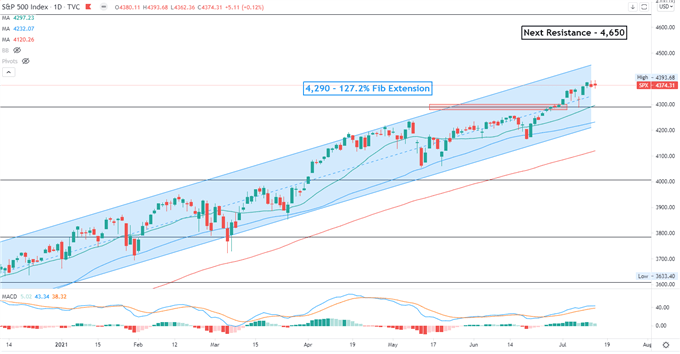

S&P 500 IndexTechnical Analysis

The S&P 500 index breach above a key resistance level at 4,290 and thus opened the door to further upside potential. The next key resistance level can be found at 4,650 – the 161.8% Fibonacci extension. The overall trend remains bullish-biased as prices continue to trend higher within a “Ascending Channel” formed since November. The MACD indicator continued to trend higher ,underscoring upward momentum.

S&P 500 Index– Daily Chart

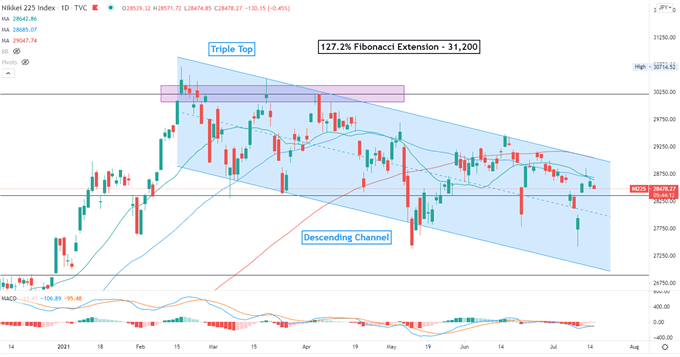

Nikkei 225 Index Technical Analysis:

The Nikkei 225 index remains in a “Descending Channel” formed since February. The floor and ceiling of the channel may be viewed as immediate support and resistance levels respectively. The overall trend remains bearish-biased as suggested by the downward-sloped SMA lines. The MACD indicator is oscillating at around the neutral line, suggesting that prices may be lack of a clear direction.

Nikkei 225 Index – Daily Chart

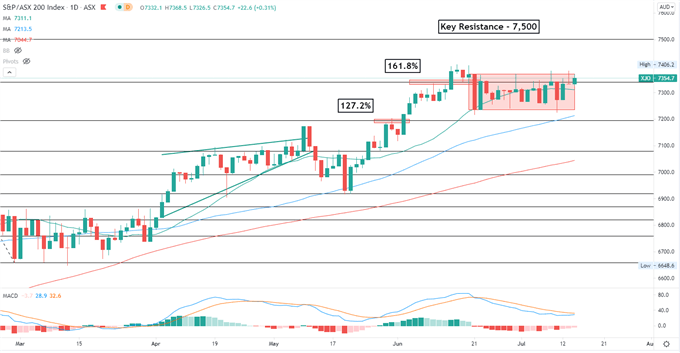

ASX 200 Index Technical Analysis:

The ASX 200 index entered a tight range between 7,230-7,370 over the past few weeks, waiting for fresh catalysts for a breakout. The overall bullish trend remains intact as suggested by the upward-sloped SMA lines. The MACD indicator is about to form a bullish crossover, suggesting that upward momentum may be building.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter