CANADIAN DOLLAR PRICE OUTLOOK: USD/CAD WHIPSAWS ON BANK OF CANADA RATE DECISION

- Canadian Dollar is trading on its back foot immediately following the latest BoC rate decision

- The Bank of Canada leaves rates unchanged and reduces its weekly pace of QE to C$2-billion

- USD/CAD price action recoiled higher off key support with help from a softer Canadian Dollar

Canadian Dollar bears are flexing their muscles and trying to steer USD/CAD price action higher this morning. Loonie softness is coming in spite of the latest monetary policy update from the Bank of Canada just crossing market wires, which revealed a notable reduction in the central bank’s QE program.

The BoC decided to reduce weekly asset purchases by one-third to C$2-billion, though this was largely in line with expectations. BoC officials left rates unchanged and also reiterated projections for economic slack to be absorbed in the second half of next year with outlook for 2022 GDP and inflation both receiving modest upgrades. That said, the Bank of Canada’s monetary policy report also detailed a slight downgrade to its 2021 GDP forecast.

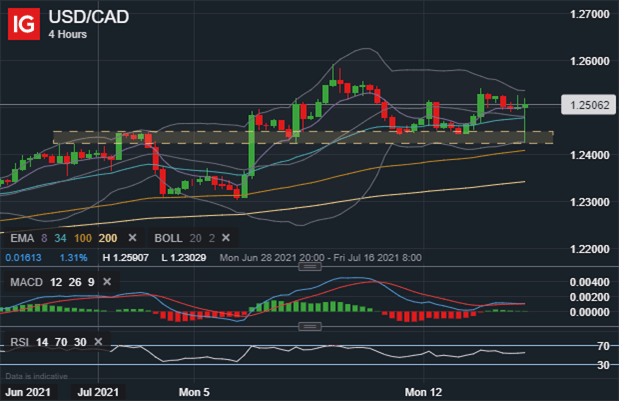

USD/CAD PRICE CHART: 4-HOUR TIME FRAME (28 JUNE TO 14 JULY 2021)

USD/CAD price action whipsawed in response to these headlines as initial Canadian Dollar strength was quickly unwound. This seemed to follow a knee-jerk reaction to key technical support around the 1.2425-1.2450 price zone. Yields on Canadian Government Bonds also felt some downward pressure and are likely contributing to a softer Loonie. That could be tracking the decline in BoC rate hike odds by year-end, which dropped to a 32% probability from 39% pre-BoC.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight