Key Talking Points:

- US PPI to be closely watched after a record beat in US CPI data

- Jerome Powell’s speech to congress in focus

- USD/JPY and USD/CAD levels to watch

After yesterday’s strong beat in US CPI data, the attention has circled back to inflation once again, but there is a different twist to it this time. Bond yields continue to be tamed and the US Dollar is struggling to keep Tuesday’s bullish momentum despite consumer prices hitting their highest level since 2008 and that is a sign that markets are more convinced about the transitory nature of rising prices.

The key barometer for this will be the US PPI data out this afternoon, where we are likely to see the first signs of a slowdown in inflationary pressures that will eventually flow down the production line. And we’ve already seen producer prices come in weaker than expected in June both in China and in the UK, which is a positive sign that the US may see prices stabilize in the coming weeks.

I’m sure Jerome Powell will be keeping a close eye out for the data coming out this afternoon as he is due to give a speech to Congress this evening, and a weaker than expected PPI reading would be the perfect evidence for him to continue defending that price pressures are transitory in nature and that once base effects are stripped out the data is just showing the natural course of an economic recovery.

If, alternatively, we continue to see price pressures increase in producers then concerns about inflation will likely intensify once again, which would be supportive for the US Dollar in the short-term on the back of increased likelihood that the Federal Reserve may announce changes to monetary policy in the coming months.

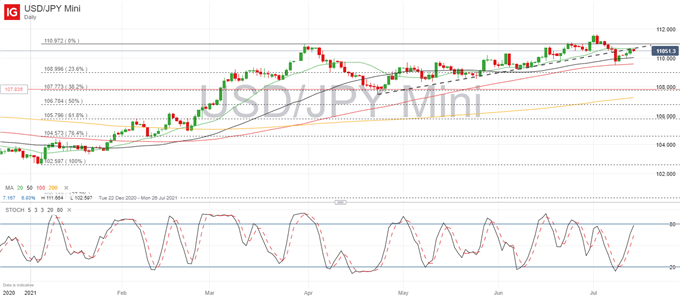

USD/JPY moves have been contained in recent sessions showing a slight risk to the downside in the short term. Moving averages are offering key areas of play with the 100 and 50-day averages holding on for support towards a move higher, whilst the 20-day average is capping US Dollar gains in today’s session. Bullish momentum is also being restricted by an ascending trendline which is now acting as resistance, so I would like to see the pair creep back above 110.67 for any further bullish momentum to consolidate. If not, watch out for the 110.0 mark for support.

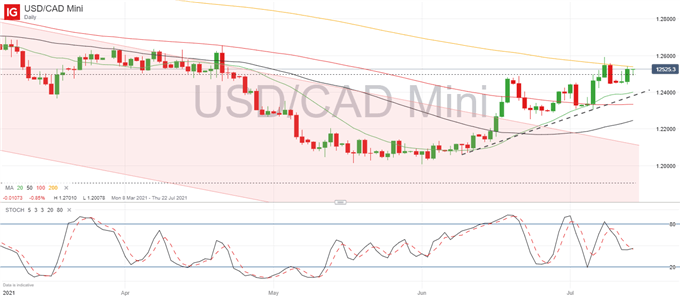

USD/CAD Daily Chart

USD/CAD had built up good momentum over the last month which has led to a breakaway from the descending channel it had been stuck in for the last 15 months. Yesterday’s strength in the USD saw the pair break above 1.25 once again but a pickup in oil prices has extended support for the commodity-linked loonie, capping the bullish break in the pair. The Bank of Canada is expected to continue its tapering program when they meet this afternoon, which is also likely to offer further support for the Canadian Dollar, looking for a pullback towards the ascending trendline support just below the 1.24 mark at 1.2386. On the topside, 1.26 is likely to be the target for bulls.

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin