AUD/USD, Chinese Balance of Trade, PBOC Talking Points:

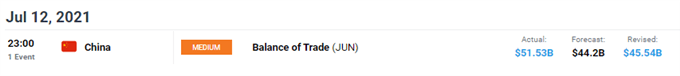

- Chinese trade balance blows away expectations, coming in at $51.53 B vs. $44.2 B est.

- China continues to worry about potential slowdown, easy monetary policy returns

- AUD/USD looks to test 0.7500 despite COVID fears weighing on sentiment

Chinese export data blew expectations out of the water Tuesday morning, despite recent worries over a slowing domestic economy. Exports for June rose 32.2% (in USD) over the same period last year. The balance of trade for June came in at $51.53 billion, vs. a consensus estimate of $44.2 billion. For the first half of 2021, China reported a trade surplus with the United States of $164.92 billion. The trade surplus with the US for the month of June came in at $32.58 billion, up from $31.78 billion in the month of May. Despite recent price pressures and intervention from Beijing, China Customs said in a statement that imported inflation risks “remain manageable.”

DailyFX Economic Calendar

For more, click here.

The strong trade prints come when China is easing monetary conditions to stave off an economic slowdown. Just last week, the People’s Bank of China (PBOC) announced that it would cut reserve requirement ratios by 0.5% for banks, with the policy taking effect on July 15. China was the only major economic power to post positive GDP growth in 2020 as coronavirus ravaged the world. But as countries around the globe prepare to tighten policy, the PBOC is now showing a cautious approach. You can read more about the state of the APAC region here.

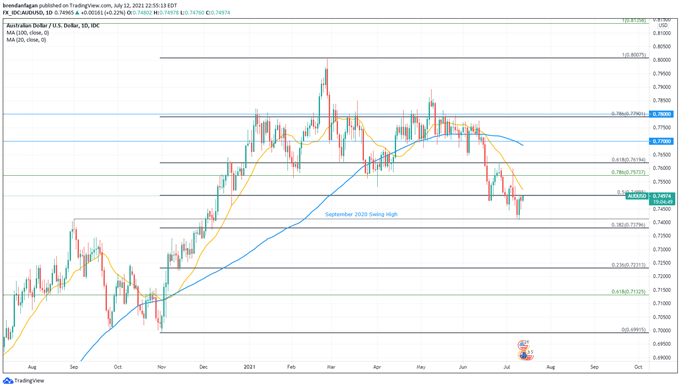

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD has been under pressure of late following renewed virus fears in Australia, along with Federal Reserve hawkishness. The Australian Dollar may potentially have bottomed following a test of September 2020’s swing high at 0.7413. Currently AUD/USD remains below the key 0.5% Fibonacci level at 0.7499, having failed to materially break above during the last few sessions. With virus fears in Australia growing, the Australian Dollar may continue to consolidate near its 2021 lows until the fundamental outlook in Australia improves.

--- Written by Brendan Fagan, Intern for DailyFX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter