Key Talking Points:

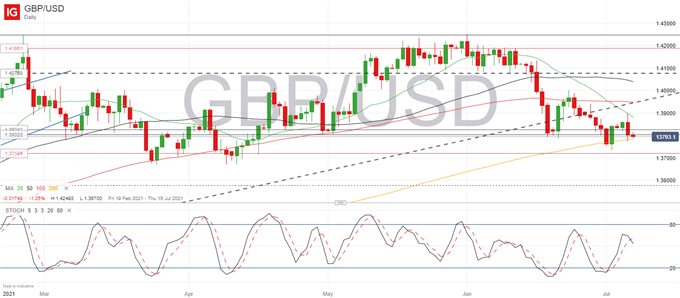

GBP/USD is at a phase where it is still hard to determine which direction it will take. The 4-week range-trade around 1.42 was a clear sign that the pair had limited upside left, but the retracement in the last three weeks has balanced out price pressures, leaving the pair at a bit of a crossroad.

Yesterday’s Dollar rally saw a somewhat more contained move in GBP/USD compared to other USD pairs, and it has left us with a clear indecision candlestick, which reinforces the perception that sellers and buyers are evenly balanced. The pullback did find support at 1.3773, meaning that a key support level (1.3720) remains intact since mid-April, but the pair also failed to break above 1.39 in its attempted recovery from a 3-month low last week.

Fundamentally, there will be a lot of focus on today’s FOMC meeting minutes to determine the future direction of the Fed’s monetary policy, but given the amount of Fed member speeches we’ve had since the meeting took place, it is kind of hard to see this as a market mover. Nonetheless, the pullback in bond yields is telling us that investors are likely expecting a less hawkish message in the meeting minutes than the meeting announcement itself, which could weigh on the Dollar heading into the end of the week.

On the UK front, there are some data releases on Friday but most of them are likely to be considered outdated and are expected to have a limited impact on the markets. The Pound is likely to remain supported as the Prime Minister has confirmed that the final opening of the United Kingdom is likely to continue on July 19, subject to final approval on July 12. Johnson said the decision to go ahead with the full take-off of the economy was mainly due to vaccines breaking the link between infections, hospitalizations, and deaths.

GBP/USD Daily chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin