Key Talking Points:

- OPEC+ meeting delay keeping commodity-linked looney supported

- USD attempts to recover from last week’s NFP drop ahead of ISM data and Fed meeting minutes

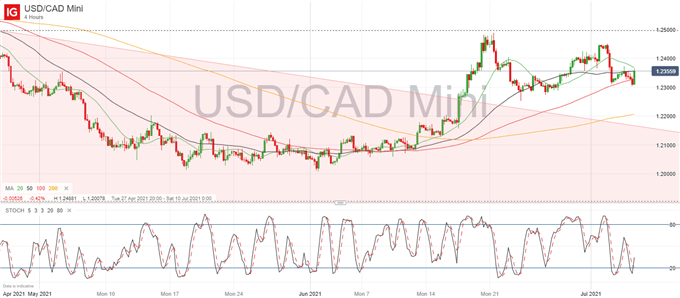

USD/CAD is holding on above 1.23 as the pair attempts to undo the drop seen last Friday after NFP data that left markets wanting more. After breaking above its long-term descending channel three weeks ago, USD/CAD has been attempting a rebound towards 1.25 but has struggled to keep momentum going as the Canadian Dollar has been benefiting from rising oil prices.

Key focus for the Loonie this week is the pending OPEC+ meeting regarding production cuts. Oil prices are going to continue benefiting from production cuts so the postponement of the meeting after Saudi Arabia and the UAE failed to agree on a date for production cuts to be lifted, raising oil prices further and keeping the Canadian Dollar supported.

USD traders are likely to be keeping an eye out for the latest ISM non-manufacturing PMI data out this afternoon, and also the meeting minutes from the Fed’s June meeting when markets took the view of a more hawkish Fed on the back of rising prices. A slight improvement in the jobs data last week will put renewed attention on the Fed’s response to improving economic conditions.

USD/CAD Levels

USD/CAD is finding it hard to push higher so I would expect the bearish bias to continue in the short term. The question now is whether the drop on Friday for the Greenback was just some position covering going into the long weekend or if there is more to this, meaning that USD/CAD could break below 1.23 again. The move so far in today’s European session is supportive for the pair, which is undoing oversold conditions after last week’s drop, which also means that there is more room for further selling ahead.

The pair seems well supported for now at the 1.23 mark so a drop below this area would likely signal further bearish bias ahead, as sellers focus on bringing USD/CAD back into its descending channel, which is now located under 1.2160. If unable to bring the pair down we may see bullish momentum consolidate towards a two-week high at 1.2488, which is in close range to a key Fibonacci level acting as resistance (127.2% at 1.2496).

USD/CAD Daily chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin