S&P 500 Price Forecast:

- The S&P 500 has seen some of its tightest daily trading ranges in the last three years this week

- History suggests the trend of low volume and volatility may persist as summer progresses

- Holiday trading conditions may distort upcoming price action - Stock Market 2021 Holiday Calendar

S&P 500 Forecast for the Week Ahead: The Summer Doldrums Drag On

The S&P 500 is on pace for another sleep-inducing week of trade as the effects of seasonality seem to grow stronger. Daily trading ranges have continued to narrow and market activity could be further distorted by the upcoming holiday weekend. The summer doldrums, a trend toward lower volume and volatility this time of year, seem to be in full swing and unfortunately for the more active traders, could persist in the weeks ahead if history is any indication.

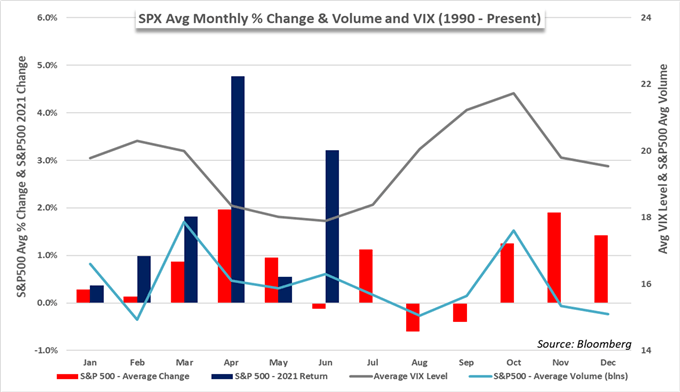

To that end, monthly S&P 500 data since 1990 reveals April to September is generally the period with the lowest volume of the year and tends to bottom in August. After a fairly uneventful conclusion to May and a largely inactive month of June, the trend of lower volume and volatility in the summer season seems poised to ring true this year.

With that in mind, market activity could slip to new lows in the coming months as traders grasp for any viable catalysts after almost 18 months of negotiating a novel market environment that saw volatility remain elevated for long periods. Whether recent price action is simply a side effect of investor fatigue rather than the underlying forces of seasonality is yet to be seen, but the trend thus far suggests the latter may carry more weight.

That said, a lack of activity has not translated to a lack of progress for the major indices as the S&P 500 and Nasdaq 100 push to new records – albeit slowly – while the Dow Jones attempts to reclaim a lost trendline that had been crucial in its climb off the pandemic lows. Despite underwhelming price action, the continuation higher is encouraging and suggests the longer-term uptrend in equities remains firmly intact. As markets search for the next catalyst, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX