USD/JPY PRICE OUTLOOK: US DOLLAR EXTENDS PULLBACK ON ISM MANUFACTURING PMI MISS

- US Dollar under pressure as Monday’s trading session gets underway

- USD/JPY price action sliding to daily lows following softer PMI data

- ISM manufacturing was reported at 60.7 versus the 65.0 forecast

The US Dollar is hitting new session lows right now in the wake of disappointing PMI data just released by the Institute of Supply Management. USD/JPY currently trades 34-pips lower intraday with the move to the downside nearly erasing last Friday’s sharp rise. According to the DailyFX Economic Calendar, the ISM manufacturing PMI crossed market wires with a reading of 60.7, which was below the 65.0 forecast. The weaker-than-expected PMI report also reflects a deceleration in manufacturing activity from last month’s print of 64.7, but the sector continues to expand nonetheless.

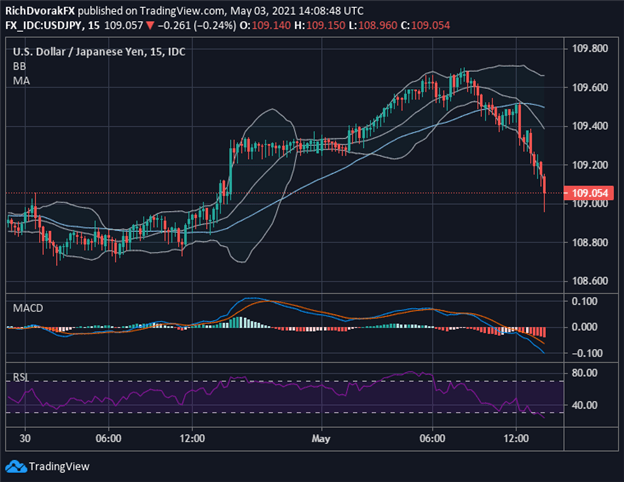

USD/JPY PRICE CHART: 15-MINUTE TIME FRAME (29 APRIL TO 03 MAY 2021)

Chart by @RichDvorakFX created using TradingView

Relatively softer PMI data may be causing an unwind of US Dollar strength seen late last week in response to Dallas Fed President Robert Kaplan suggesting it is time to start talking about FOMC tapering. To that end, USD/JPY price action could be headed toward the 108.80-level to test nearside technical support before April lows come into focus for US Dollar bears.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -1% | -1% |

| Weekly | 14% | 3% | 5% |

Keep Reading – US Dollar Technical Analysis: Needs to Climb Resistance to Continue Friday’s Move

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight