FTSE 100 Price Analysis & News

- FTSE 100 Off to a Strong Start

- Can the FTSE 100 Outperform in 2021?

- Despite Positive Outlook, FTSE 100 Faces Short-Term Risks

UK equities and in particular the FTSE 100 has been among the outperforming indices to begin the year, with the index up over 4.5%. That said, while it is early days, the FTSE 100 may well remain among the outperforming indices throughout the rest of year.

Can the FTSE 100 Outperform in 2021?

Less Uncertainty: With the EU-UK striking a Brexit trade agreement at the back-end of 2020 to end over 4 years of heightened political uncertainty, the reduction of this headwind, could see previously reluctant investors return to the market.

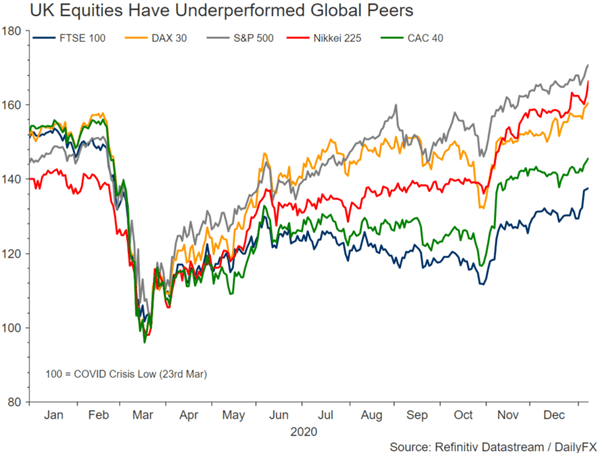

UK Equities Undervalued Relative to Peers: The FTSE 100 has since been the underperforming index following the Q1 2020 crash. However, with a vaccine being rolled out, despite the recent surge in virus cases globally, leading to renewed lockdown measures, there is light at the end of the tunnel. In particular, for the FTSE 100, there is a sizeable amount of catching up to do, therefore, investors seeking value, could perhaps be best placed comparatively cheaper index, such as the FTSE 100.

Reflation Sectors: Elsewhere, as investors look for an upswing in economic activity to spark global economic growth, the reflation theme is likely to support those sectors with exposure to commodities, alongside the financial sector, which has been recently underpinned by the pick-up in bond yields. This is important to consider, given that the FTSE 100 has a relatively high exposure to commodities and financials. Alongside this, as concerns grow over excessive valuations across the tech sector, may flock to those indices limited tech exposure, such as the FTSE 100.

FTSE 100 Sector Weighting: Consumer Staples (19%), Financials (17.2%), Materials (14.15%), Health Care (10.2%), Industrials (10.2%), Energy (9.4%), Consumer Discretionary (8.3%), Communication Services (4.5%), Utilities (3.5%), IT (1.3%), Real Estate (1.1%)

Find out more on FTSE 100 companies and price movements

Despite Positive Outlook, FTSE 100 Faces Short-Term Risks

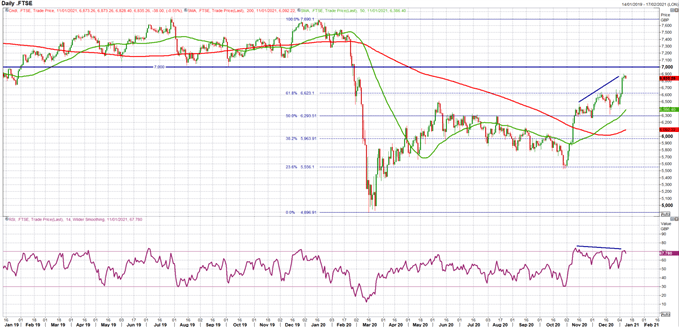

Much like the rest of the equity complex, the FTSE 100 is pulling back from its recent highs. Short-term concerns over soaring virus cases presents an immediate risk to market sentiment. On the technical front, the relative strength index has yet to confirm the higher highs in the index with a slight bearish divergence emerging, as such a pullback in the index, places the 61.8% Fibonacci retracement (6620) back in focus, with a break below opening the doors to 6500.

FTSE 100 Chart: Daily Time Frame

Source: Refinitiv

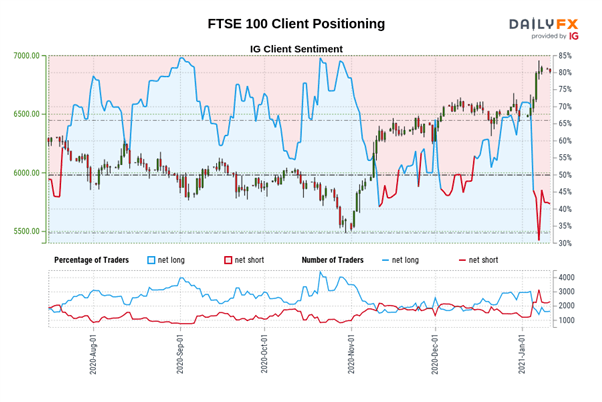

FTSE 100 Retail Positioning

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |