AUD, NZD 1Q Forecasts: Commodity Currency Breakout in 2021? Cyclical Upturn Ahead for AUD & NZD

2021 could prove to be the start of a commodity-currency bull market, as long-term price analysis suggests a cyclical shift may be afoot for AUD, NZD against the haven-linked USD.

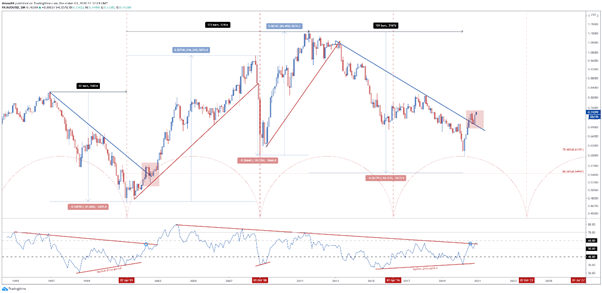

AUD/USD Monthly Chart

Chart prepared by Daniel Moss, created with TradingView

The chart above highlights the cyclical nature seen in AUD/USD rates over the past 24 years, with the currency pair largely adhering to what appears to be an 8-year rotation. It has set significant bottoms in early 2001, late 2008 and 2016.

Recent price action looks strikingly like that seen early in the bullish cycle ignited in September 2001 and could be indicative of further upside for AUD/USD, given price has cleared the downtrend extending from the 2013 high and remains perched constructively above key support at the psychologically pivot 0.7000 mark.

Moreover, with the RSI breaking above the downtrend extending from the 2004 extremes – in a similar fashion to late 2002 – a shift in overall market sentiment seems to be taking shape.

With that in mind, the trade-sensitive exchange rate could be poised to substantially extend its recent 35% surge from the March nadir, with cycle analysis suggesting AUD/USD may rise as much as 44% from current levels to eventually peak in late 2025.

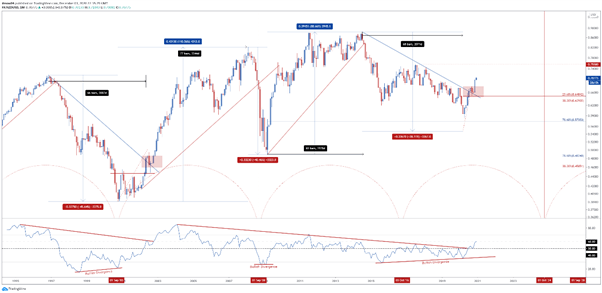

NZD/USD Monthly Chart

Chart prepared by Daniel Moss, created with TradingView

NZD/USD rates also seem to adhere to an 8-year rotation, setting significant bottoms in late 2000, early 2009 and mid-2015.

Bullish RSI divergence appears to signal the end of each successive cycle and could indicate a period of sustained NZD strength against the haven-associated USD.

Once again, recent price action is notably similar to that seen in 2002 and suggests that NZD/USD could drastically extend its 30% rise from the coronavirus-crisis low set in March.

Cycle analysis implying that the exchange rate may climb an additional 39% from current levels to peak in early 2026.