Key Talking Points:

- Brexit deal is said to be imminent

- UK mid-cap stocks pushing higher

- UK stock market to close early at 12.30 pm GMT

UK shares soared this morning on reports that Boris Johnson and Ursula von der Leyen will be confirming that a Brexit trade agreement has been reached. UK retailers and banks jumped higher yesterday afternoon as the first reports came in about a possible agreement, with many shares gapping up higher this morning, as Lloyds Bank (+6%), Persimmon (+4.1%) and Berkeley Group Holdings (+3.3%) lead the gains in the FTSE 100.

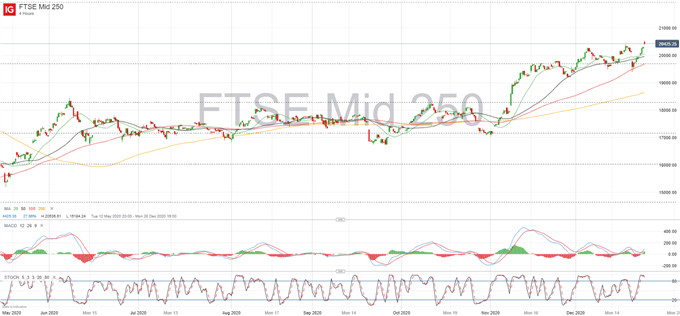

Domestically-focused mid-cap FTSE 250, considered a proxy to Brexit sentiment, is quickly picking up buyer support as the blue-chip FTSE 100 is weighed down by a stronger pound, but this is largely a reversal of the declines seen in the lead up to this round of negotiations. UK shares are likely to balance at current prices until the deal is fully confirmed, at which point I expect to see UK shares drift higher, given that most of the expected deal is priced in already, with the FTSE 250 most likely outperforming in Europe.

Stock Market Holiday Calendar 2020/21

Current price is hovering around the 20,500 line after a gap higher at the open, but is slightly coming off the daily high as expectation builds for the announcement, which has been pushed back twice as final details are finalized. Momentum indicators have a strong bearish bias, but overbought conditions are strong, so price reversal could be strong if uncertainty builds. A long-term target could be seen around the 21,200 level but strong resistance is likely to appear along the way as the coronavirus pandemic unfolds.

FTSE 250 4-Hour chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin