S&P 500 PRICE OUTLOOK: STOCKS UNFAZED BY TEPID US ECONOMIC DATA DUMP WITH RISK SENTIMENT FOCUSED ON BREXIT, COVID, & STIMULUS

- S&P 500 Index futures edging toward session highs despite decelerating economic data

- Stocks looking past a big miss on personal income and spending with Brexit in focus

- Markets likely staying forward-looking as vaccine and stimulus optimism drives the bid

The S&P 500 Index looks primed to start the session modestly higher with futures pointing to a 0.33% gain at the open. Stocks appear to be gaining ground on the back of a positive lead-in from Europe as markets react to Brexit headlines hinting at a potential UK-EU trade deal. Improving market sentiment likely follows the perceived reduction in odds of no-deal Brexit. This could explain why US equities seem to be overlooking uninspiring economic data just crossing the wires and why the broader US Dollar is facing renewed selling pressure.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

CORE PCE, DURABLE GOODS ORDERS, JOBLESS CLAIMS, PERSONAL SPENDING & PERSONAL INCOME DATA MIXED

Chart Source: DailyFX Economic Calendar

The latest barrage of US economic data was mixed on balance. A big miss on personal income and personal spending figures stand out most prominently. The preferred measure of inflation tracked by the Federal Reserve, core PCE, also missed market forecast. Durable goods orders and weekly jobless claims were bright spots, however.

Overall, it appears that the economic data is having a muted reaction on stocks. Aside from the latest Brexit developments, equities likely have their attention honed in on vaccine and stimulus optimism. US politicians are flirting the idea of bringing a standalone fiscal aid bill to the floor that would boost the $600 coronavirus check to $2,000 if passed.

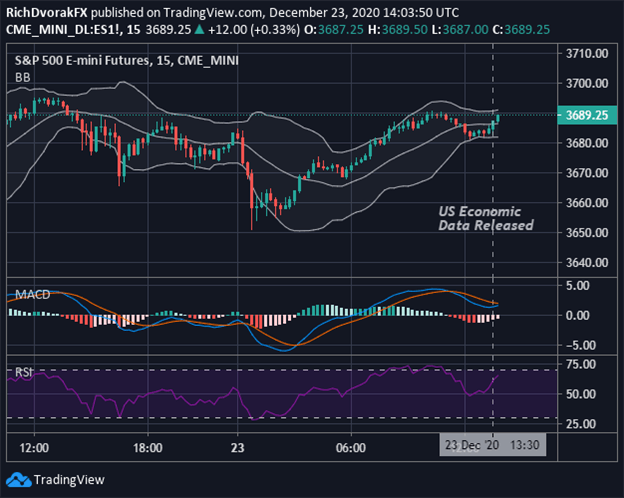

S&P 500 INDEX PRICE CHART: 15-MINUTE TIME FRAME (22 DEC TO 23 DEC 2020)

Chart by @RichDvorakFX created using TradingView

S&P 500 price action has slid lower for the past three trading sessions, but the popular equity benchmark has so far held its 20-day simple moving average. This could suggest, at least for now, that stock market bulls remain in control despite recent turbulence. The 3,600-price level stands out as a potential level of technical support whereas week-to-date highs around the 3,720-mark could serve as an area of resistance.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight