EUR/USD, EUR/JPY Analysis & News

EUR/USD Dips Buyers Keep Risks Balanced

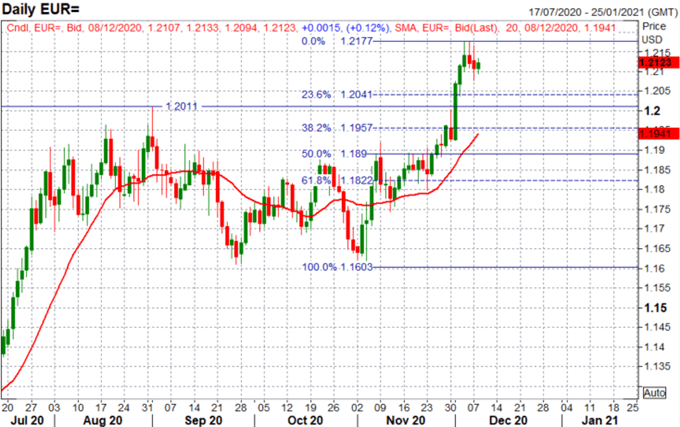

EUR/USD: Recent price action in the pair signals that risks are looking more balanced with the Euro struggling for a further upside with multiple failures in the 1.2165-75 region. That said, dips below 1.21 have been shortlived with initial support at 1.2070-75. However, with concerns remaining over Poland and Hungary maintaining their stance over the EU budget veto and with a dovish ECB meeting expected on Thursday, I do not rule out a pullback before the next leg higher. Keep in mind that while the ECB is expected to boost PEPP by another EUR 500bln, a lot of focus will be on the commentary surrounding the Euro given the speed of its appreciation. Although, little/no commentary on the exchange rate could be met with a hawkish reaction with Euro pushing higher, given that this would suggest the ECB are comfortable with the rise in the Euro.

For more information on the ECB, check out this beginners guide to central banks

EUR/USD Technical Levels

Pivot Points: 1.2117 (Pivot)Support: 1.2068, 1.2028, 1.1979Resistance: 1.2157, 1.2206, 1.2255

Key Fibonacci Retracement Levels: 1.2041, 1.1957

A traders guide to identifying key support and demand zones in FX trading, click here

Euro Chart: Daily Time Frame

Source: Refinitiv

EUR/JPY Challenging Key Trendline Resistance

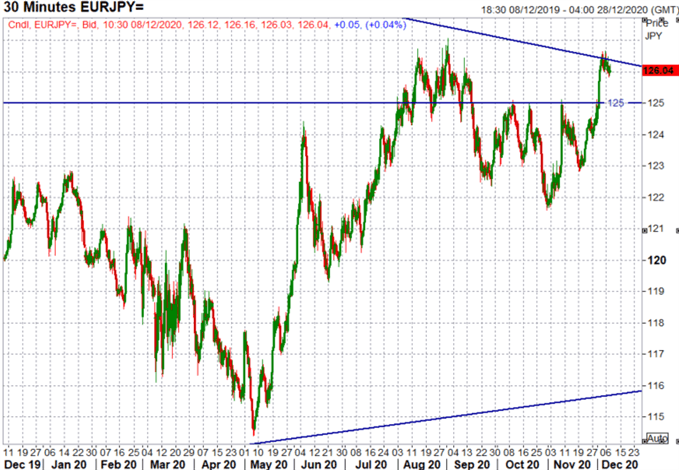

EUR/JPY: The cross is testing key trendline resistance stemming from the 2015 peak, however, with the yearly high and 2019 peak situated at 127.07 and 127.50 respectively, this looks to be a tough level to break on its first test. In turn, pullbacks are likely to find support at 125.00 where failure to hold puts the 124.00 handle back in focus thus reducing the risk of a break of the 5-year trendline.

Trend is your friend, Using Trendlines in FX Trading

EUR/JPY Chart: Weekly Time Frame

Source: Refinitiv

EUR/JPY Chart: 30 Minute Time Frame

Source: Refinitiv