Australian Dollar, AUD/USD, RBA – Talking Points

- Reserve Bank of Australia keeps the official cash rate at 0.10%

- Economic recovery remains dependent on Covid-19 path

- AUD/USD looks to challenge bullish price reaction at 2020 highs

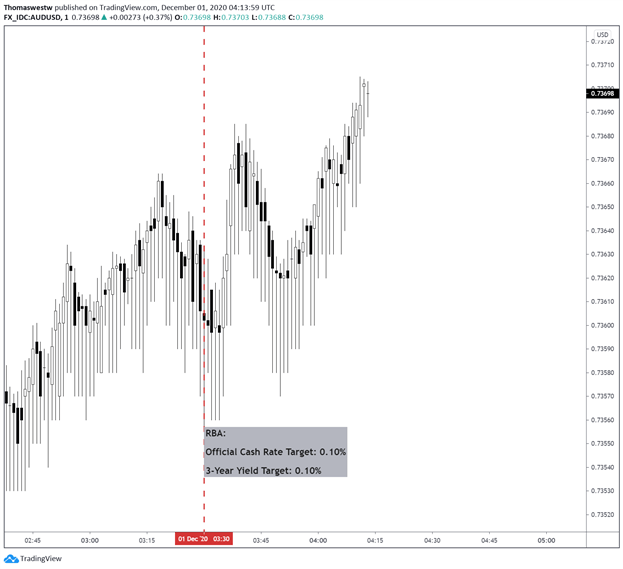

The Reserve Bank of Australia kept its official cash rate unchanged at 0.10% on Tuesday. The rate hold was widely expected following better-than-expected economic data in recent weeks. Still, the economic outlook remains fragile and susceptible to the path of Covid-19. AUD/USD gyrated to the upside, but price action may remain volatile while traders digest the RBA's latest move.

The monetary policy statement kept the target on the 3-year Australian government bond yield unchanged at 0.10%. In line with the unchanged cash and yield target rates, no changes were announced to the RBA’s asset purchase program. For now, it appears the RBA is taking a wait-and-see approach while the path of Covid becomes clearer, particularly amid recent vaccine hopes.

AUD/USD One-Minute Chart

Chart created with TradingView

The RBA statement reflects recently upbeat economic data points. Still, the central scenario forecasts GDP remaining below pre-pandemic levels until the end of 2021. Citing an “uneven and drawn out” recovery, the RBA made clear that continued monetary and fiscal support is necessary.

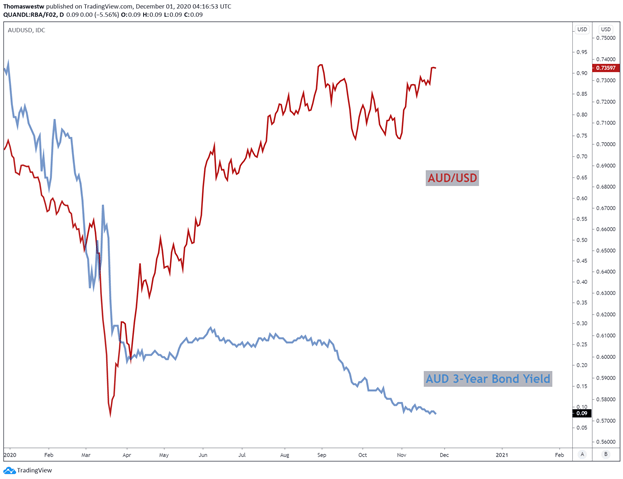

Indeed, monetary measures are almost certainly helping economic recovery in Australia. Today’s statement cites its recent actions to lower rates across the whole yield curve. Furthermore, year-to-date, the balance sheet has grown around A$130 billion from a combination of bond purchases and actions to support the 3-year yield target.

AUD/USD vs 3-Year Bond Yield – Daily Chart

Chart created with TradingView

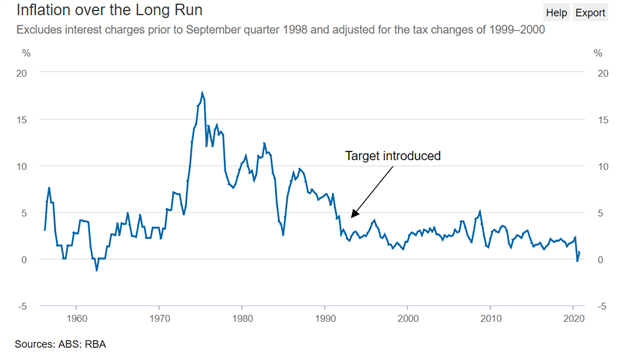

These actions from the RBA will likely continue until inflation and employment reach a healthy range. A sustainable inflation target within the 2-3% target range will be required for the RBA to scale back current policy support, according to today’s statement. Thus, wage growth will need to see a substantial increase from current levels. For now, according to the RBA, the cash rate will be held for at least 3 years, and the bond purchase program will remain under ongoing review.

RBA Inflation Target

Source: RBA.GOV.AU

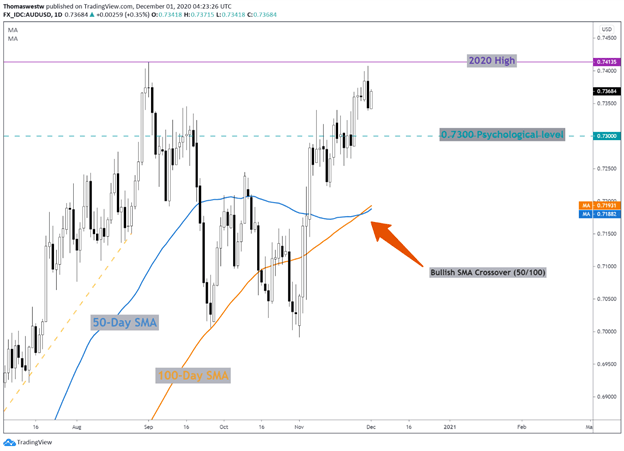

AUD/USD is pushing higher following the RBA decision. The main technical challenge is the 2020 high at 0.7413, where price action fell short last week. A recent bullish SMA crossover may help propel the pair higher. To the downside, the 0.7300 psychological level is eyed as initial support in the event of a pullback.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter