Market sentiment analysis:

- Traders seem less confident about global stocks, although there has been little impact so far on either currencies or commodities.

- Driving sentiment are concerns about rising Covid-19 cases in Europe and the US, as well as worries about the lack of agreement on a US fiscal stimulus package.

- Nonetheless, IG Client Sentiment data are sending out bullish contrarian trading signals for both NZD/USD and Bitcoin.

Trader sentiment subdued

Market confidence in stocks, especially in the US, is falling as traders worry about rising Covid-19 cases in the US and Europe, a lack of progress in the talks on a US fiscal stimulus program and caution ahead of next Tuesday’s US elections.

Nonetheless, these fears do not seem to have spread to the currency and commodity markets, and IG Client Sentiment data are currently sending out a bullish contrarian signal on NZD/USD, which is widely seen as a “risk on” currency pair.

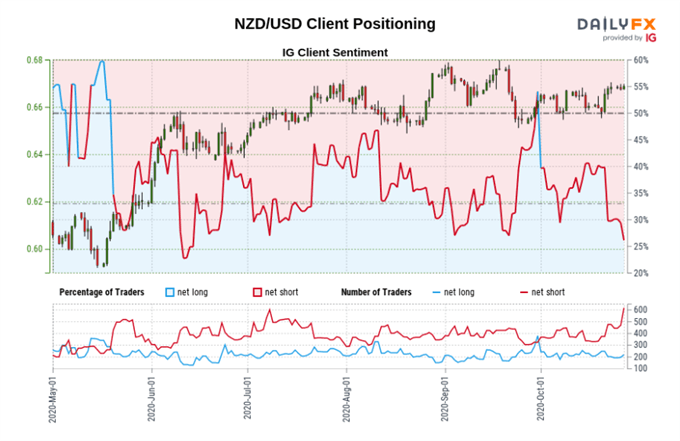

IG Client Sentiment Data for NZD/USD

Source: DailyFX (You can click on it for a larger image)

The figures show 27.51% of traders are net-long, with the ratio of traders short to long at 2.63 to 1. The number of traders net-long is 14.42% higher than yesterday and 7.69% higher than last week, while the number of traders net-short is 26.92% higher than yesterday and 71.78% higher than last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests NZD/USD prices may continue to rise.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

Similarly, the data are also sending a bullish contrarian trading signal for Bitcoin.

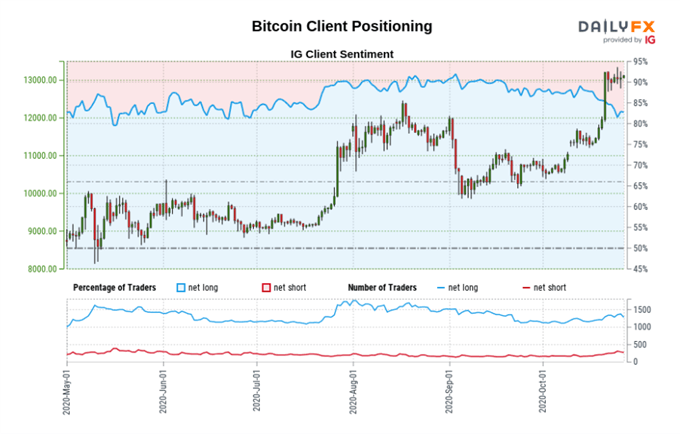

IG Client Sentiment Data for Bitcoin

Source: DailyFX (You can click on it for a larger image)

The figures show 82.45% of traders are net-long, with the ratio of traders long to short at 4.70 to 1. The number of traders net-long is 6.47% lower than yesterday and 5.38% higher than last week, while the number of traders net-short is 3.21% lower than yesterday and 52.25% higher than last week.

As mentioned earlier, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall.Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Bitcoin price trend may soon move higher despite the fact traders remain net-long.

In this webinar, I looked at the trends in the major currency, commodity and stock markets, at the forward-looking data on the economic calendar this week, at the IG Client Sentiment page on the DailyFX website, and at the IG Client Sentiment reports that accompany it. You might also like to check out the DailyFX Trading Global Markets Decoded podcasts.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me on Twitter @MartinSEssex