CRUDE OIL OUTLOOK:

- WTI crude oil prices edged higher after gaining 3% overnight, US Dollar fell

- Second US fiscal stimulus hopes and falling API crude stockpiles boosted energy prices

- A firm breakthrough above the 200-Day SMA at US$ 40.4 may open room for more upside

WTI crude oil prices (WTI) rebounded more than 3% overnight, boosted by a falling weekly crude inventory report and reignited hopes that the US government may eventually strike a fiscal stimulus. Speaker of the House, Nancy Pelosi, and Treasury Secretary Steven Mnuchin met on Wednesday, agreeing to postpone a vote to buy more time for the final deal.

A softer US Dollar is also underpinning commodity prices. The US Dollar index fell for a third straight day to 93.7 as riskier currencies rebounded on improved sentiment.

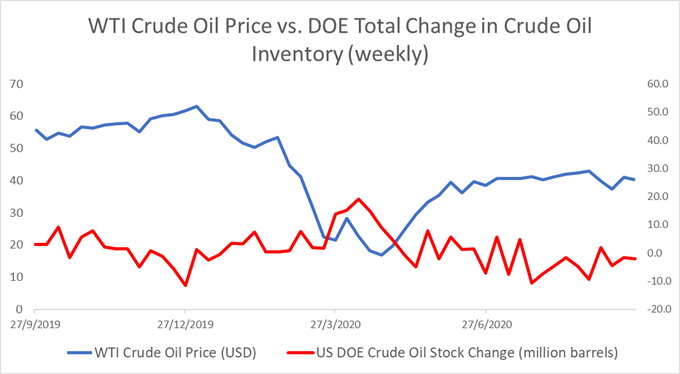

US crude oil inventories dropped 1.98 million barrels last week, more than the 1.57 million forecast. This also marks a third straight weekly decline of US crude stockpiles, according to EIA DOE reports. The inverse correlation between oil prices and inventory changes is visualized in the chart below.

Source: DailyFX, Bloomberg

Oil traders are eyeing a string of key macroeconomic data for clues about the energy demand outlook. Those include a string of EU and US Markit manufacturing PMIs, and US inflation data. Read more on our economic calendar.

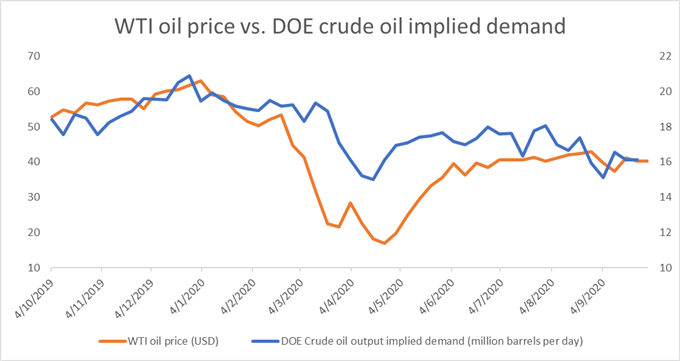

Despite falling stockpiles, the EIA DOE report has painted a tepid energy demand outlook (see chart below), with implied demand falling to 16 million recently from 18 million barrels per day in end July. Demand concerns and a potential second viral wave during the winter season may continue to weigh on sentiment in the weeks to come.

Source: DailyFX, Bloomberg

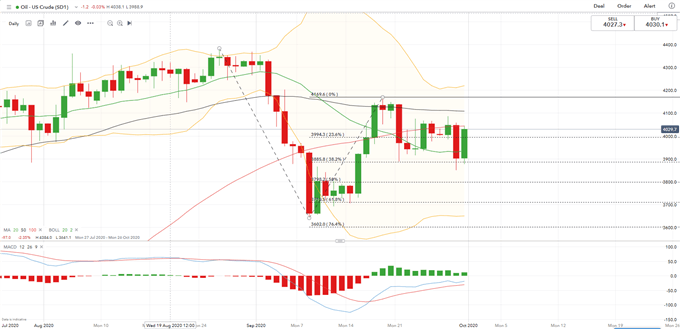

Technically,WTI crude oil price managed to hold above its 20-Day SMA this week. It may attempt to challenge an immediate resistance level at US$ 40.40 - the 100-Day SMA. Its Bollinger Band width has narrowed recently, suggesting that price may have entered into a period of consolidation. A key support level can be found at US$ 38.85 – the 38.2% Fibonacci extension.

WTI Crude Oil Price – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter