S&P 500, NIKKEI 225, ASX 200 INDEX OUTLOOK:

- S&P 500 index climbed 0.83% on stimulus hopes, better job data after the presidential debate

- ASX 200 index opened 0.8% higher. Tokyo Stock Exchange suspended trading due to a system glitch

- Hong Kong and mainland China stock exchanges shut for National Day holiday

S&P 500 Index Outlook:

The 1stUS presidential debate didn’t bring much of surprises to investors in terms of candidates’ economic and foreign policy prescriptions. Post-debate polls suggest that Joe Biden continued to lead, with Trump’s approval rate falling. Looking ahead, market focus might shift back to the fundamental elements until the 2nd presidential debate takes place on 15th October.

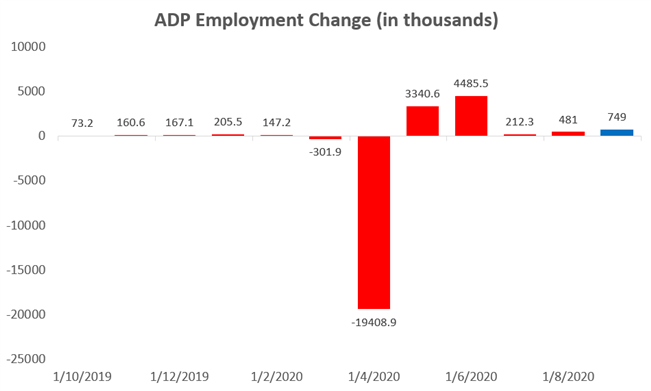

A better-than-expected US ADP jobs report, alongside reignited US fiscal stimulus hopes boosted market confidence. The September ADP job reading came in at 749k, higher than a 650k forecast (see chart below). The August figure was revised up to 481k from previous reading of 428k, pointing to a gradual recovery of the private employment market. This Friday’s non-farm payrolls report is of high importance too. Economists’ sees some 850k non-farm jobs created in September, a revision down from the previous month’s reading of 1.37 million.

US ADP Employment Change - September 2020

Source: DailyFX

Asia-Pacific markets may follow the US leads higher, as the futures market suggests. The Tokyo Stock Exchange said that it would suspend trading in all stocks, due to a glitch in its system to distribute market information.

Traders face a fairly packed calendar today, with South Korea’s balance of trade, a string of EU and US Markit manufacturing PMIs, and US inflation among top market events. Read more on our economic calendar website.

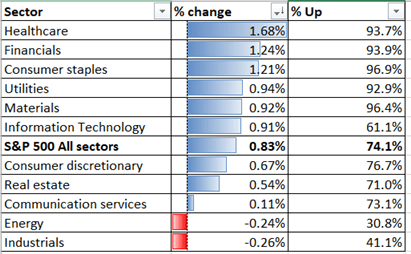

Overnight trading displayed a positive sectoral pattern, with 74.1% of the S&P 500 index constituents closed in the green. Healthcare (+1.68%), financials (+1.24%) and consumer staples (+1.21%) were among the best performers, whereas energy (-0.24%) and industrials (-0.26%) were lagging.

S&P 500 Sector performance 30-9-2020

Source: Bloomberg, DailyFX

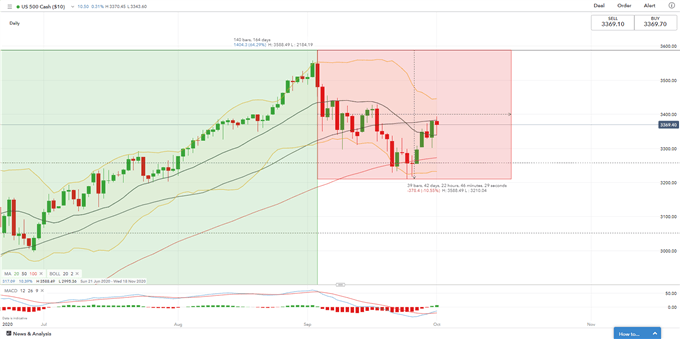

Technically,the S&P 500 index has likely broken above its 20-Day Simple Moving Average (SMA) line, penetrating into the upper Bollinger Band for the first time since it entered into a consolidation in early September (chart below). This may suggest a potential trend reversal should the index stay within the upper Bollinger Band in the next few days. an immediate resistance level can be found at 3,380 – the 50-Day SMA line. The MACD indicator has likely formed a bullish crossover, pointing to more upside potential.

S&P 500 Index – Daily Chart

ASX 200 Index Outlook:

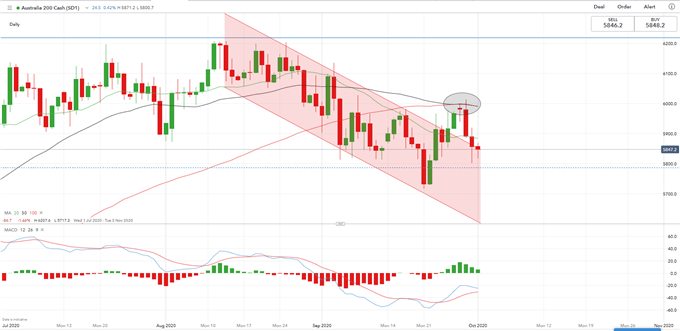

Australia’s ASX 200 index opened 0.8% higher, ceasing a two-day loss. The index has previously broken an “Descending Channel”, facing strong resistance at around 6,000 where its 50-Day and 100-Day SMA overlaps. The ASX 200 index may find an immediate support at 5,850 – the upper bound of its “Descending Channel”. Previous resistance has now become a support level.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter