EUR/GBP Analysis:

- UK exporters could face lengthy queues at Kent as the EU plans to enforce full goods controls

- UK PMI data prints largely in line with expectations

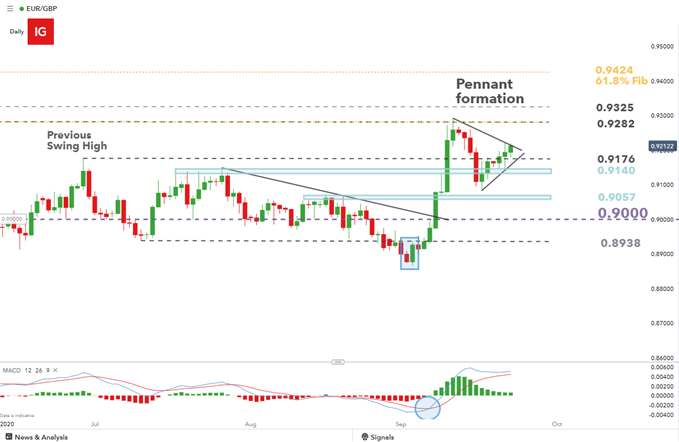

- EUR/GBP Price action: Bullish pennant forming as price consolidates

UK Government Publishes "Worst-Case Scenario" in Letter to the Freight Industry

Michael Gove, who is responsible for no-deal planning, issued a warning to the freight industry over potential import and export delays in Kent. Mr Gove mentioned that as many as 7000 EU-bound freight trucks could cause delays of up to 2 days. The reason for this is, according to Gove, is due to around 70% of freight trucks travelling to the EU being unprepared for the new border controls.

The European Union is expected to impose full goods controls on the UK, stopping all freight without the correct documentation after the transition period, effective from 1 January 2021.

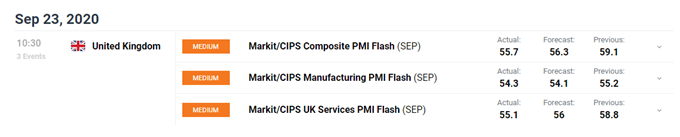

UK PMI Data Prints Largely in line with Expectations

Similarly to other economies, there was an expectation for improved economic conditions as the UK eased up on lockdown restrictions. Manufacturing (Flash) PMI data slightly beat expectations; while Markit/CIPS Composite (Flash) and Markit/CIPS UK Services PMI (Flash) came in slightly below expectations. Traditionally, figures above the 50 mark indicate improving economic activity.

Economic calendar

For all market-moving data releases and events see the DailyFX Economic Calendar

EUR/GBP Key Technical Levels

The EUR/GBP currency pair looks to have consolidated after the bullish MACD crossover and bullish engulfing pattern preceded the strong advance in price.

A break above the pennant formation may lead to a continuation of the initial bullish advance (flagpole). Continued bullish price action brings into focus the 0.9282 level which is the 50% fib extension (drawn from the Feb low to March high to April low). The next level of potential resistance is the 0.9325 followed by the 61.8% Fib extension at 0.9424.

However, a breakdown of the bullish pennant would require a break below the 0.9176 level and the lower trendline. Continued bearish momentum would bring into play the 0.9140 and 0.9057 zones of support before the psychological round number of 0.9000 becomes potential support.

EUR/GBP Daily Chart: Pennant formation

Chart prepared by Richard Snow, IG

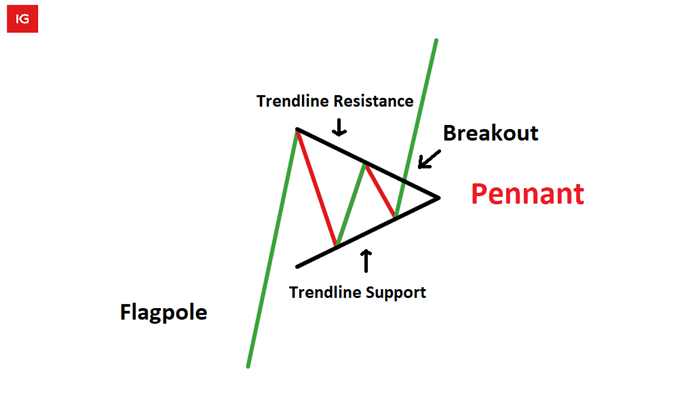

Learn how to identify and apply the bullish pennant on price charts

Bullish Pennant Pattern

Chart prepared by Richard Snow, IG

We have an entire library of educational content via our DailyFX Education Section

Fundamental Factors Supporting the bullish Pennant

- ECB stance on the stronger Euro: ECB President, Christine Legarde, mentioned in the most recent press conference that there is no need to overreact to the appreciation of the Euro and that the bank does not target the FX rate – see our former report for the full story. This sparked a bullish run in the Euro against many of its peers and may continue in the absence of any mention from the ECB committee to combat the stronger Euro.

- EU-UK Brexit Negotiations: Lately there has been little progress between EU and UK Brexit negotiators as both parties have failed to agree on the way forward regarding state aid and the fisheries. The potential trucking backlog in Kent only adds to this further and presents a challenge for the Pound.

- BoE policy: Bank of England governor, Andrew Bailey clarified yesterday that the bank was in no hurry to adopt a negative interest rate policy after much speculation around last weeks MPC minutes, which revealed that the committee would consider how negative interest rates could technically be implemented. While the possibility of negative interest rates is not imminent, it is being considered and this could present a headwind for Sterling.

However, there is always the possibility of a breakdown of this pattern which underscores the importance of sound risk management. Refer to the key technical levels in the event of a breakdown that have been identofied above.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX