USD/ZAR TALKING POINTS

- South African Rand clawing back yesterday’s depreciation against the US Dollar

- Long upper wicks may favor ZAR bulls

- Fundamental factors driving USD/ZAR recent price action

SOUTH AFRICAN RAND PULLING BACK

After last weeks South African Reserve Bank (SARB) decision to keep interest rates on hold, the Rand has since given back much of the post-meeting gains. This comes after surging COVID-19 cases in Europe along with stricter lockdown measures have been imposed, which could hinder previously optimistic expectations for economic recovery within the region. The recent price fluctuations within the USD/ZAR pair shows how sensitive the ZAR has been along with other Emerging Market (EM) currencies are to global risk sentiment.

Visit the DailyFX Educational Center to discover more on why news events are essential to FX fundamental analysis

ZAR TECHNICAL ANALYSIS

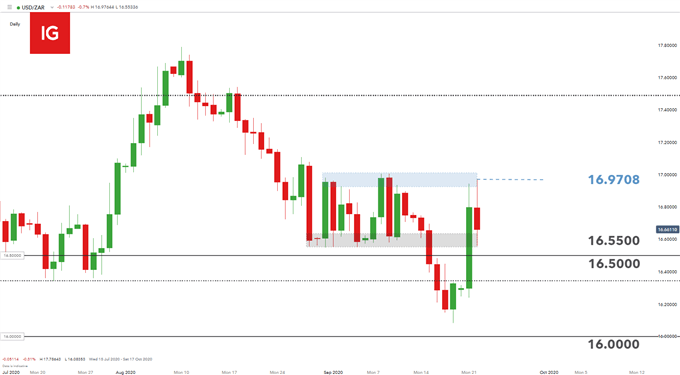

USD/ZAR: Daily Chart

Chart prepared by Warren Venketas, IG

The daily chart above shows an almost full retracement of last week’s ZAR gains. Price action has attempted to pierce the 17.0000 psychological level with no success as yesterday and today buyers fell slightly short, with today’s high reaching 16.9708. Bears have defended this recent resistance zone (blue) resulting in two long upper wick candles. An extended candle formation like this can further support the thesis of the sellers defending resistance at this confluent area on the chart. Although these are not textbook reversal candles, they may indicate a similar short-term signal in favor of the bigger-picture downward trend.

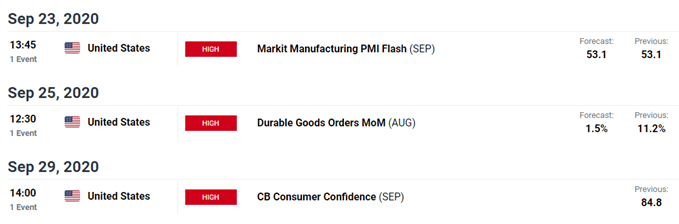

If the continued ZAR strength ensues the 16.5500 support zone (black) becomes of interest. Today has already seen a test of this support area. Any break below could result in the 16.5000 horizontal level being the next area of support. A lot is dependent on global risk appetite which appears to be highly correlated to the pandemic at this point. With no major Rand specific fundamental news scheduled over the coming week, US economic data (see calendar below) and US elections will likely provide additional price stimulus for the rest of the week.

USD/ZAR STRATEGY MOVING FORWARD

The medium to long-term outlook for ZAR remains positive with possible political reforms and hopes of a vaccine on the horizon. The implementation of domestic changes will ultimately determine the road ahead for the Rand. Policy structure and focus seem to tick all the right boxes but corruption continues to hinder forecasted progress.

Key points to consider:

- Short-term support and resistance zones

- 16.5000 psychological level

- Global risk outlook: Coronavirus (Europe)

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas